Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

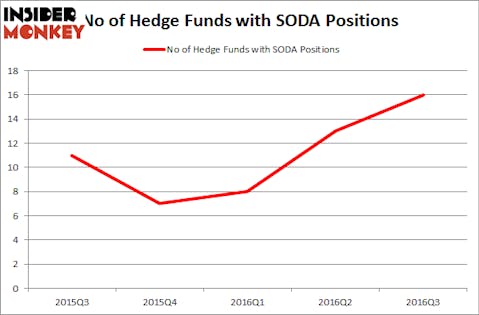

Is Sodastream International Ltd (NASDAQ:SODA) the right investment to pursue these days? Investors who are in the know are taking an optimistic view. The number of bullish hedge fund positions that are disclosed in regulatory 13F filings went up by 3 in recent months. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as InnerWorkings, Inc. (NASDAQ:INWK), State National Companies Inc (NASDAQ:SNC), and First Financial Corp (NASDAQ:THFF) to gather more data points.

Follow Sodastream International Ltd (NASDAQ:SODA)

Follow Sodastream International Ltd (NASDAQ:SODA)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

nito/Shutterstock.com

What does the smart money think about Sodastream International Ltd (NASDAQ:SODA)?

At Q3’s end, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a 23% increase from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SODA over the last 5 quarters, which shows a 100% surge over the past 2 quarters, as hedge funds rapidly pile into the stock. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Wilmot B. Harkey and Daniel Mack’s Nantahala Capital Management has the largest position in Sodastream International Ltd (NASDAQ:SODA), worth close to $35 million, amounting to 4.2% of its total 13F portfolio. On Nantahala Capital Management’s heels is Renaissance Technologies, founded by Jim Simons, holding a $15.3 million position. Remaining members of the smart money that are bullish contain Joseph Mathias’ Concourse Capital Management, Josh Goldberg’s G2 Investment Partners Management, and Ken Griffin’s Citadel Investment Group. We should note that Nantahala Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, key money managers have been driving this bullishness. Citadel Investment Group initiated the biggest call position in Sodastream International Ltd (NASDAQ:SODA). Citadel Investment Group had $1.8 million invested in the company at the end of the quarter. Frank Slattery’s Symmetry Peak Management also made a $0.6 million investment in the stock during the quarter. The following funds were also among the new SODA investors: Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Sodastream International Ltd (NASDAQ:SODA) but similarly valued. These stocks are InnerWorkings, Inc. (NASDAQ:INWK), State National Companies Inc (NASDAQ:SNC), First Financial Corp (NASDAQ:THFF), and Mesa Laboratories, Inc. (NASDAQ:MLAB). All of these stocks’ market caps match SODA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INWK | 12 | 53532 | 1 |

| SNC | 11 | 68148 | 0 |

| THFF | 5 | 7444 | 0 |

| MLAB | 5 | 44719 | 0 |

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $43 million. That figure was $67 million in SODA’s case. InnerWorkings, Inc. (NASDAQ:INWK) is the most popular stock in this table. On the other hand First Financial Corp (NASDAQ:THFF) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Sodastream International Ltd (NASDAQ:SODA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None