After several tireless days we have finished crunching the numbers from nearly 900 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of June 30th. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Moneygram International Inc (NASDAQ:MGI).

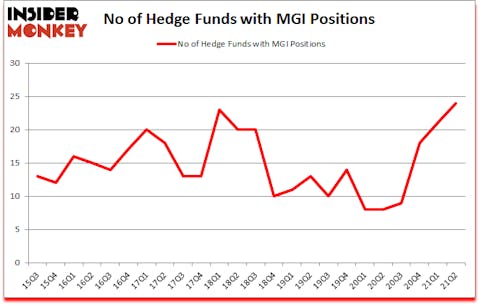

Is Moneygram International Inc (NASDAQ:MGI) a bargain? Prominent investors were becoming more confident. The number of bullish hedge fund positions moved up by 3 in recent months. Moneygram International Inc (NASDAQ:MGI) was in 24 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic was previously 23. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that MGI isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 21 hedge funds in our database with MGI holdings at the end of March.

In the eyes of most traders, hedge funds are perceived as underperforming, old financial tools of the past. While there are more than 8000 funds with their doors open at the moment, Our researchers look at the aristocrats of this group, about 850 funds. Most estimates calculate that this group of people direct bulk of all hedge funds’ total asset base, and by paying attention to their finest equity investments, Insider Monkey has brought to light various investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let’s view the fresh hedge fund action surrounding Moneygram International Inc (NASDAQ:MGI).

Do Hedge Funds Think MGI Is A Good Stock To Buy Now?

At second quarter’s end, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 14% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MGI over the last 24 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Portolan Capital Management was the largest shareholder of Moneygram International Inc (NASDAQ:MGI), with a stake worth $30.5 million reported as of the end of June. Trailing Portolan Capital Management was Engle Capital, which amassed a stake valued at $30.2 million. Arctis Global, Archon Capital Management, and Renaissance Technologies were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Yost Capital Management allocated the biggest weight to Moneygram International Inc (NASDAQ:MGI), around 8.44% of its 13F portfolio. Arctis Global is also relatively very bullish on the stock, earmarking 4.9 percent of its 13F equity portfolio to MGI.

Consequently, key hedge funds were breaking ground themselves. Arctis Global, managed by Viraj Mehta, established the most valuable position in Moneygram International Inc (NASDAQ:MGI). Arctis Global had $30.1 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also made a $15 million investment in the stock during the quarter. The following funds were also among the new MGI investors: Zachary Miller’s Parian Global Management, Carson Yost’s Yost Capital Management, and Peter S. Park’s Park West Asset Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Moneygram International Inc (NASDAQ:MGI) but similarly valued. These stocks are NetSTREIT Corp. (NYSE:NTST), Rafael Holdings, Inc. (NYSE:RFL), Interface, Inc. (NASDAQ:TILE), iTeos Therapeutics, Inc. (NASDAQ:ITOS), Heritage Financial Corporation (NASDAQ:HFWA), WisdomTree Investments, Inc. (NASDAQ:WETF), and The Gorman-Rupp Company (NYSE:GRC). This group of stocks’ market values match MGI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTST | 10 | 105672 | 0 |

| RFL | 8 | 55044 | 0 |

| TILE | 11 | 28490 | -1 |

| ITOS | 15 | 192274 | 3 |

| HFWA | 8 | 21282 | 3 |

| WETF | 26 | 79096 | 8 |

| GRC | 8 | 27052 | 0 |

| Average | 12.3 | 72701 | 1.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.3 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $224 million in MGI’s case. WisdomTree Investments, Inc. (NASDAQ:WETF) is the most popular stock in this table. On the other hand Rafael Holdings, Inc. (NYSE:RFL) is the least popular one with only 8 bullish hedge fund positions. Moneygram International Inc (NASDAQ:MGI) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for MGI is 82.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and beat the market again by 1.6 percentage points. Unfortunately MGI wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on MGI were disappointed as the stock returned -33.5% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Moneygram International Inc (NASDAQ:MGI)

Follow Moneygram International Inc (NASDAQ:MGI)

Receive real-time insider trading and news alerts

Suggested Articles:

- 16 Best Beginner Stocks to Invest in Right Now

- 20 Best Cities for Single Males in 2021

- 10 Best Dividend Stocks to Buy According to Terry Smith

Disclosure: None. This article was originally published at Insider Monkey.