How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Tsakos Energy Navigation Ltd. (NYSE:TNP) and determine whether hedge funds had an edge regarding this stock.

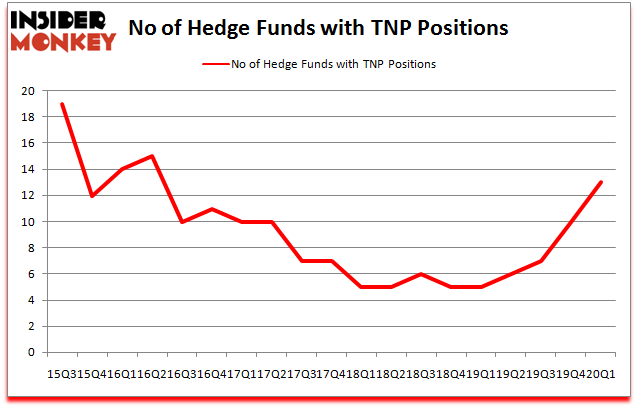

Tsakos Energy Navigation Ltd. (NYSE:TNP) has seen an increase in support from the world’s most elite money managers recently. Our calculations also showed that TNP isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. There is a lot of volatility in the markets and this presents amazing investment opportunities from time to time. For example, this trader claims to deliver juiced up returns with one trade a week, so we are checking out his highest conviction idea. A second trader claims to score lucrative profits by utilizing a “weekend trading strategy”, so we look into his strategy’s picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We recently recommended several stocks partly inspired by legendary Bill Miller’s investor letter. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to take a look at the fresh hedge fund action surrounding Tsakos Energy Navigation Ltd. (NYSE:TNP).

What does smart money think about Tsakos Energy Navigation Ltd. (NYSE:TNP)?

At Q1’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 30% from the previous quarter. The graph below displays the number of hedge funds with bullish position in TNP over the last 18 quarters. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

The largest stake in Tsakos Energy Navigation Ltd. (NYSE:TNP) was held by Kopernik Global Investors, which reported holding $12 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $10.6 million position. Other investors bullish on the company included Millennium Management, Arrowstreet Capital, and Two Sigma Advisors. In terms of the portfolio weights assigned to each position Kopernik Global Investors allocated the biggest weight to Tsakos Energy Navigation Ltd. (NYSE:TNP), around 2.55% of its 13F portfolio. Diametric Capital is also relatively very bullish on the stock, dishing out 0.91 percent of its 13F equity portfolio to TNP.

As one would reasonably expect, some big names were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the biggest position in Tsakos Energy Navigation Ltd. (NYSE:TNP). Marshall Wace LLP had $0.2 million invested in the company at the end of the quarter. Brian C. Freckmann’s Lyon Street Capital also made a $0.1 million investment in the stock during the quarter. The other funds with brand new TNP positions are Matthew Hulsizer’s PEAK6 Capital Management and Greg Eisner’s Engineers Gate Manager.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Tsakos Energy Navigation Ltd. (NYSE:TNP) but similarly valued. We will take a look at Benefitfocus Inc (NASDAQ:BNFT), GasLog Ltd (NYSE:GLOG), Cheetah Mobile Inc (NYSE:CMCM), and Oceaneering International, Inc. (NYSE:OII). This group of stocks’ market valuations resemble TNP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BNFT | 13 | 18792 | 0 |

| GLOG | 13 | 13283 | -2 |

| CMCM | 4 | 4160 | 0 |

| OII | 19 | 29958 | -5 |

| Average | 12.25 | 16548 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $17 million. That figure was $33 million in TNP’s case. Oceaneering International, Inc. (NYSE:OII) is the most popular stock in this table. On the other hand Cheetah Mobile Inc (NYSE:CMCM) is the least popular one with only 4 bullish hedge fund positions. Tsakos Energy Navigation Ltd. (NYSE:TNP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.3% in 2020 through June 25th but beat the market by 16.8 percentage points. Unfortunately TNP wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on TNP were disappointed as the stock returned -33.9% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Tsakos Energy Navigation Ltd (NYSE:TNP)

Follow Tsakos Energy Navigation Ltd (NYSE:TNP)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.