The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Washington Prime Group Inc (NYSE:WPG).

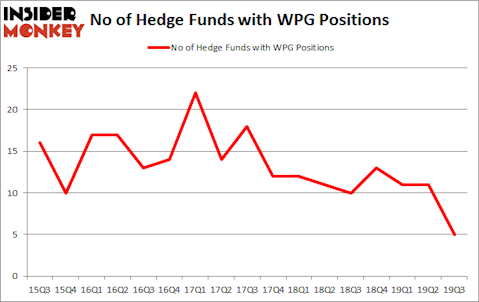

Is Washington Prime Group Inc (NYSE:WPG) worth your attention right now? Investors who are in the know are reducing their bets on the stock. The number of long hedge fund positions retreated by 6 in recent months. Our calculations also showed that WPG isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). WPG was in 5 hedge funds’ portfolios at the end of September. There were 11 hedge funds in our database with WPG positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are plenty of tools market participants can use to analyze their holdings. Some of the most useful tools are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the top investment managers can trounce the broader indices by a significant amount (see the details here).

Ken Griffin of Citadel Investment Group

We leave no stone unturned when looking for the next great investment idea. For example one of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Keeping this in mind we’re going to go over the fresh hedge fund action regarding Washington Prime Group Inc (NYSE:WPG).

How have hedgies been trading Washington Prime Group Inc (NYSE:WPG)?

At the end of the third quarter, a total of 5 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -55% from the second quarter of 2019. By comparison, 10 hedge funds held shares or bullish call options in WPG a year ago. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

The largest stake in WPG was held by ZWEIG DIMENNA PARTNERS, which reported holding $7.5 million worth of stock at the end of September. It was followed by Arrowstreet Capital with a $1 million position. Other investors bullish on the company included Citadel Investment Group, AQR Capital Management, and Gotham Asset Management. In terms of the portfolio weights assigned to each position ZWEIG DIMENNA PARTNERS allocated the biggest weight to WPG, around 0.67% of its 13F portfolio. Arrowstreet Capital is also relatively very bullish on the stock, earmarking 0.0023 percent of its 13F equity portfolio to WPG.

Since WPG has experienced a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there were a few funds that decided to sell off their full holdings last quarter. Intriguingly, John Overdeck and David Siegel’s Two Sigma Advisors said goodbye to the largest investment of all the hedgies monitored by Insider Monkey, totaling an estimated $2.6 million in stock, and Bill Miller’s Miller Value Partners was right behind this move, as the fund said goodbye to about $2.2 million worth. These moves are interesting, as total hedge fund interest fell by 6 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to WPG. These stocks are ZIOPHARM Oncology Inc. (NASDAQ:ZIOP), ScanSource, Inc. (NASDAQ:SCSC), Dime Community Bancshares, Inc. (NASDAQ:DCOM), and William Lyon Homes (NYSE:WLH). All of these stocks’ market caps resemble WPG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZIOP | 16 | 142289 | 4 |

| SCSC | 11 | 52810 | 3 |

| DCOM | 10 | 41957 | 1 |

| WLH | 29 | 164043 | 5 |

| Average | 16.5 | 100275 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $100 million. That figure was $9 million in WPG’s case. William Lyon Homes (NYSE:WLH) is the most popular stock in this table. On the other hand Dime Community Bancshares, Inc. (NASDAQ:DCOM) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Washington Prime Group Inc (NYSE:WPG) is even less popular than DCOM. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on WPG, though not to the same extent, as the stock returned 6.5% during the fourth quarter (through 11/30) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.