Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Sony Group Corp (NYSE:SONY).

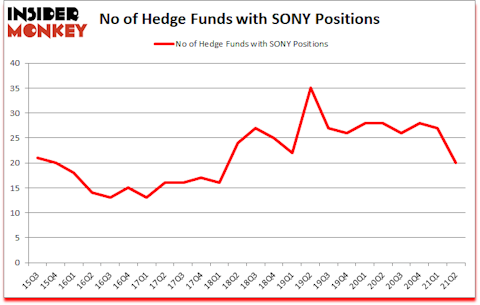

Is Sony Group Corp (NYSE:SONY) a cheap investment today? Prominent investors were in a bearish mood. The number of bullish hedge fund positions dropped by 7 lately. Sony Group Corp (NYSE:SONY) was in 20 hedge funds’ portfolios at the end of June. The all time high for this statistic is 35. Our calculations also showed that SONY isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 185.4% since March 2017 and outperformed the S&P 500 ETFs by more than 79 percentage points (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, plant based food market is expected to explode 100-fold by 2050, so we are checking out this under-the-radar stock. We go through lists like the 10 best growth stocks to buy to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now we’re going to take a look at the new hedge fund action regarding Sony Group Corp (NYSE:SONY).

Do Hedge Funds Think SONY Is A Good Stock To Buy Now?

Heading into the third quarter of 2021, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -26% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in SONY over the last 24 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, GAMCO Investors was the largest shareholder of Sony Group Corp (NYSE:SONY), with a stake worth $187.5 million reported as of the end of June. Trailing GAMCO Investors was Renaissance Technologies, which amassed a stake valued at $44.8 million. Citadel Investment Group, Millennium Management, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Humankind Investments allocated the biggest weight to Sony Group Corp (NYSE:SONY), around 2.64% of its 13F portfolio. Bourgeon Capital is also relatively very bullish on the stock, dishing out 2.27 percent of its 13F equity portfolio to SONY.

Judging by the fact that Sony Group Corp (NYSE:SONY) has experienced bearish sentiment from the aggregate hedge fund industry, logic holds that there is a sect of fund managers who sold off their full holdings in the second quarter. It’s worth mentioning that Paul Marshall and Ian Wace’s Marshall Wace LLP said goodbye to the biggest stake of all the hedgies monitored by Insider Monkey, valued at close to $34 million in stock, and Martin D. Sass’s MD Sass was right behind this move, as the fund dropped about $30.7 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 7 funds in the second quarter.

Let’s also examine hedge fund activity in other stocks similar to Sony Group Corp (NYSE:SONY). We will take a look at Target Corporation (NYSE:TGT), Caterpillar Inc. (NYSE:CAT), TotalEnergies SE (NYSE:TTE), General Electric Company (NYSE:GE), HSBC Holdings plc (NYSE:HSBC), Vale SA (NYSE:VALE), and The Estee Lauder Companies Inc (NYSE:EL). All of these stocks’ market caps are closest to SONY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TGT | 66 | 5865028 | 6 |

| CAT | 62 | 5264268 | 9 |

| TTE | 15 | 1132420 | -2 |

| GE | 67 | 6087180 | -1 |

| HSBC | 11 | 212763 | -1 |

| VALE | 27 | 3573958 | -4 |

| EL | 50 | 4129744 | -9 |

| Average | 42.6 | 3752194 | -0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 42.6 hedge funds with bullish positions and the average amount invested in these stocks was $3752 million. That figure was $409 million in SONY’s case. General Electric Company (NYSE:GE) is the most popular stock in this table. On the other hand HSBC Holdings plc (NYSE:HSBC) is the least popular one with only 11 bullish hedge fund positions. Sony Group Corp (NYSE:SONY) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for SONY is 23.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. A small number of hedge funds were also right about betting on SONY as the stock returned 16.2% since the end of the second quarter (through 10/22) and outperformed the market by an even larger margin.

Follow Sony Group Corp (NYSE:SONY)

Follow Sony Group Corp (NYSE:SONY)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Best Gourmet Coffee Brands In The World

- 15 Best Clean Energy Stocks to Invest In

- 10 Most Profitable Movies Of All Time

Disclosure: None. This article was originally published at Insider Monkey.