We are still in an overall bull market and many stocks that smart money investors were piling into surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Hedge funds’ top 3 stock picks returned 41.7% this year and beat the S&P 500 ETFs by 14 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Orion Energy Systems, Inc. (NYSE:OESX).

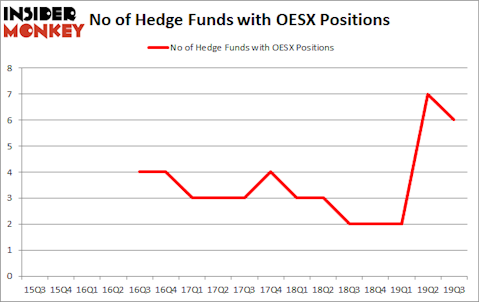

Is Orion Energy Systems, Inc. (NYSE:OESX) the right investment to pursue these days? Investors who are in the know are turning less bullish. The number of bullish hedge fund bets shrunk by 1 in recent months. Our calculations also showed that OESX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). OESX was in 6 hedge funds’ portfolios at the end of September. There were 7 hedge funds in our database with OESX holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are plenty of gauges stock market investors have at their disposal to size up stocks. A pair of the most underrated gauges are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the elite investment managers can outclass the market by a superb margin (see the details here).

Jim Simons of Renaissance Technologies

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Keeping this in mind we’re going to view the recent hedge fund action encompassing Orion Energy Systems, Inc. (NYSE:OESX).

How are hedge funds trading Orion Energy Systems, Inc. (NYSE:OESX)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in OESX over the last 17 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, holds the most valuable position in Orion Energy Systems, Inc. (NYSE:OESX). Renaissance Technologies has a $5.2 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Sitting at the No. 2 spot is John W. Rogers of Ariel Investments, with a $1.7 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining peers that hold long positions comprise Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Israel Englander’s Millennium Management and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Algert Coldiron Investors allocated the biggest weight to Orion Energy Systems, Inc. (NYSE:OESX), around 0.04% of its 13F portfolio. Ariel Investments is also relatively very bullish on the stock, setting aside 0.02 percent of its 13F equity portfolio to OESX.

Due to the fact that Orion Energy Systems, Inc. (NYSE:OESX) has faced bearish sentiment from the aggregate hedge fund industry, logic holds that there was a specific group of fund managers that elected to cut their entire stakes heading into Q4. Interestingly, Bradley Louis Radoff’s Fondren Management said goodbye to the biggest investment of the “upper crust” of funds monitored by Insider Monkey, valued at an estimated $0.2 million in stock. Thomas Bailard’s fund, Bailard Inc, also sold off its stock, about $0.1 million worth. These bearish behaviors are interesting, as total hedge fund interest dropped by 1 funds heading into Q4.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Orion Energy Systems, Inc. (NYSE:OESX) but similarly valued. These stocks are A-Mark Precious Metals, Inc. (NASDAQ:AMRK), Aravive, Inc. (NASDAQ:ARAV), Abraxas Petroleum Corp. (NASDAQ:AXAS), and Aduro BioTech Inc (NASDAQ:ADRO). This group of stocks’ market values resemble OESX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMRK | 3 | 1227 | 0 |

| ARAV | 4 | 9718 | 0 |

| AXAS | 8 | 9618 | -1 |

| ADRO | 9 | 6771 | 1 |

| Average | 6 | 6834 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $7 million. That figure was $8 million in OESX’s case. Aduro BioTech Inc (NASDAQ:ADRO) is the most popular stock in this table. On the other hand A-Mark Precious Metals, Inc. (NASDAQ:AMRK) is the least popular one with only 3 bullish hedge fund positions. Orion Energy Systems, Inc. (NYSE:OESX) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately OESX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); OESX investors were disappointed as the stock returned 2.8% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.