Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The last 12 months is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Luby’s, Inc. (NYSE:LUB).

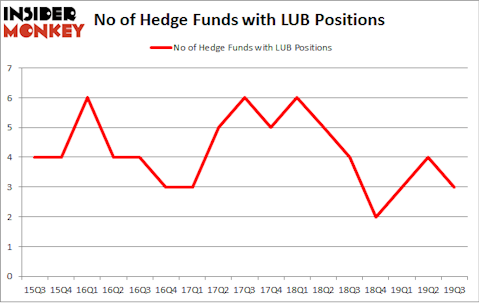

Luby’s, Inc. (NYSE:LUB) shareholders have witnessed a decrease in activity from the world’s largest hedge funds recently. LUB was in 3 hedge funds’ portfolios at the end of September. There were 4 hedge funds in our database with LUB positions at the end of the previous quarter. Our calculations also showed that LUB isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most traders, hedge funds are assumed to be unimportant, outdated financial tools of the past. While there are over 8000 funds in operation at present, Our researchers choose to focus on the moguls of this group, around 750 funds. These investment experts shepherd most of all hedge funds’ total capital, and by monitoring their matchless investments, Insider Monkey has uncovered numerous investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Jim Simons of Renaissance Technologies

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s check out the latest hedge fund action encompassing Luby’s, Inc. (NYSE:LUB).

What does smart money think about Luby’s, Inc. (NYSE:LUB)?

At Q3’s end, a total of 3 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from the second quarter of 2019. By comparison, 4 hedge funds held shares or bullish call options in LUB a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

More specifically, Bandera Partners was the largest shareholder of Luby’s, Inc. (NYSE:LUB), with a stake worth $4.7 million reported as of the end of September. Trailing Bandera Partners was Fondren Management, which amassed a stake valued at $2 million. Renaissance Technologies was also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Bandera Partners allocated the biggest weight to Luby’s, Inc. (NYSE:LUB), around 2.94% of its portfolio. Fondren Management is also relatively very bullish on the stock, setting aside 1.69 percent of its 13F equity portfolio to LUB.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Citadel Investment Group. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 750+ hedge funds tracked by Insider Monkey identified LUB as a viable investment and initiated a position in the stock.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Luby’s, Inc. (NYSE:LUB) but similarly valued. We will take a look at Mereo BioPharma Group plc (NASDAQ:MREO), Gridsum Holding Inc. (NASDAQ:GSUM), Full House Resorts, Inc. (NASDAQ:FLL), and Espey Mfg. & Electronics Corp. (NYSE:ESP). This group of stocks’ market values resemble LUB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MREO | 4 | 2778 | 0 |

| GSUM | 5 | 9525 | 1 |

| FLL | 6 | 7121 | 1 |

| ESP | 1 | 3487 | 0 |

| Average | 4 | 5728 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4 hedge funds with bullish positions and the average amount invested in these stocks was $6 million. That figure was $7 million in LUB’s case. Full House Resorts, Inc. (NASDAQ:FLL) is the most popular stock in this table. On the other hand Espey Mfg. & Electronics Corp. (NYSE:ESP) is the least popular one with only 1 bullish hedge fund positions. Luby’s, Inc. (NYSE:LUB) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. A small number of hedge funds were also right about betting on LUB as the stock returned 9.5% during Q4 (through 11/22) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.