Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those successful funds in these small-cap stocks. In the following paragraphs, we analyze LPL Financial Holdings Inc (NASDAQ:LPLA) from the perspective of those successful funds.

Is LPL Financial Holdings Inc (NASDAQ:LPLA) a healthy stock for your portfolio? Money managers are categorically taking a bearish view. The number of long hedge fund bets that are revealed through the 13F filings shrunk by 1 recently. There were 12 hedge funds in our database with LPLA positions at the end of the 2016 third quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as REGAL-BELOIT CORPORATION (NYSE:RBC), Avista Corp (NYSE:AVA), and The Medicines Company (NASDAQ:MDCO) to gather more data points.

Follow Lpl Financial Holdings Inc. (NASDAQ:LPLA)

Follow Lpl Financial Holdings Inc. (NASDAQ:LPLA)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Keeping this in mind, we’re going to view the key action regarding LPL Financial Holdings Inc (NASDAQ:LPLA).

What have hedge funds been doing with LPL Financial Holdings Inc (NASDAQ:LPLA)?

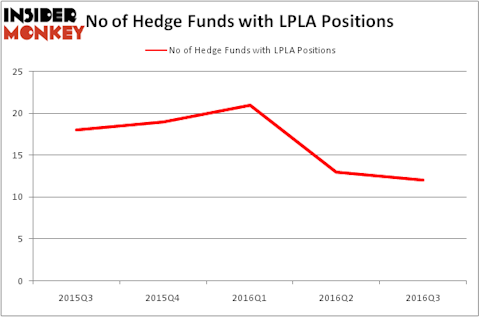

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a decline of 8% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards LPLA over the last 5 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, FPR Partners, led by Bob Peck and Andy Raab, holds the biggest position in LPL Financial Holdings Inc (NASDAQ:LPLA). The fund reportedly has a $358.1 million position in the stock, comprising 8.1% of its 13F portfolio. The second largest stake is held by SPO Advisory Corp, led by John H. Scully, which holds a $258.2 million position; 4.5% of its 13F portfolio is allocated to the company. Other members of the smart money with similar optimism contain Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC, Sharlyn C. Heslam’s Stockbridge Partners and Mick Hellman’s HMI Capital. We should note that SPO Advisory Corp is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Judging by the fact that LPL Financial Holdings Inc (NASDAQ:LPLA) has gone through bearish sentiment from the aggregate hedge fund industry, logic holds that there exists a select few hedgies that decided to sell off their entire stakes last quarter. Interestingly, Millennium Management, one of the 10 largest hedge funds in the world got rid of the largest investment of all the investors followed by Insider Monkey, totaling close to $5 million in stock. David E. Shaw’s D E Shaw was right behind this move, as the fund dropped about $1.3 million worth of LPLA shares.

Let’s also examine hedge fund activity in other stocks similar to LPL Financial Holdings Inc (NASDAQ:LPLA). These stocks are REGAL-BELOIT CORPORATION (NYSE:RBC), Avista Corp (NYSE:AVA), The Medicines Company (NASDAQ:MDCO), and SM Energy Co. (NYSE:SM). This group of stocks’ market values resemble LPLA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RBC | 21 | 158826 | 6 |

| AVA | 9 | 56026 | -3 |

| MDCO | 27 | 584714 | 1 |

| SM | 28 | 322360 | 8 |

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $280 million. That figure was $965 million in LPLA’s case. SM Energy Co. (NYSE:SM) is the most popular stock in this table. On the other hand Avista Corp (NYSE:AVA) is the least popular one with only 9 bullish hedge fund positions. LPL Financial Holdings Inc (NASDAQ:LPLA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SM might be a better candidate to consider taking a long position in.

Disclosure: none.