Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost around 20%. Facebook, which was the second most popular stock, lost 14% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

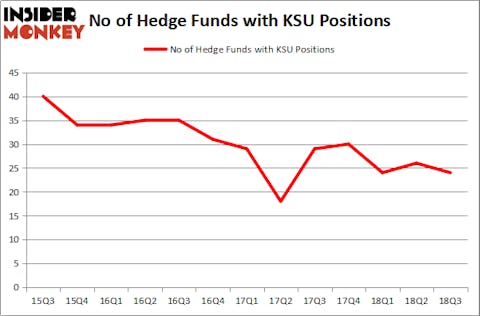

Is Kansas City Southern (NYSE:KSU) a buy, sell, or hold? Investors who are in the know are reducing their bets on the stock. The number of bullish hedge fund positions decreased by 2 recently. Our calculations also showed that KSU isn’t among the 30 most popular stocks among hedge funds. KSU was in 24 hedge funds’ portfolios at the end of the third quarter of 2018. There were 26 hedge funds in our database with KSU holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the fresh hedge fund action regarding Kansas City Southern (NYSE:KSU).

What have hedge funds been doing with Kansas City Southern (NYSE:KSU)?

At the end of the third quarter, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -8% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in KSU over the last 13 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Eric W. Mandelblatt and Gaurav Kapadia’s Soroban Capital Partners has the biggest call position in Kansas City Southern (NYSE:KSU), worth close to $113.3 million, corresponding to 1.7% of its total 13F portfolio. The second most bullish fund manager is Cliff Asness of AQR Capital Management, with a $60.1 million position; 0.1% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that are bullish contain John Brennan’s Sirios Capital Management, Phill Gross and Robert Atchinson’s Adage Capital Management and D. E. Shaw’s D E Shaw.

Due to the fact that Kansas City Southern (NYSE:KSU) has experienced declining sentiment from the smart money, it’s safe to say that there were a few funds that slashed their entire stakes by the end of the third quarter. Intriguingly, Israel Englander’s Millennium Management dropped the biggest position of the “upper crust” of funds tracked by Insider Monkey, comprising close to $31.8 million in stock. Brandon Haley’s fund, Holocene Advisors, also dumped its stock, about $12.7 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 2 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to Kansas City Southern (NYSE:KSU). We will take a look at IDEX Corporation (NYSE:IEX), Braskem SA (NYSE:BAK), Martin Marietta Materials, Inc. (NYSE:MLM), and Mid America Apartment Communities Inc (NYSE:MAA). This group of stocks’ market values are closest to KSU’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IEX | 23 | 357504 | 5 |

| BAK | 13 | 401115 | -4 |

| MLM | 33 | 1484382 | 0 |

| MAA | 15 | 316981 | 1 |

| Average | 21 | 639996 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $640 million. That figure was $364 million in KSU’s case. Martin Marietta Materials, Inc. (NYSE:MLM) is the most popular stock in this table. On the other hand Braskem SA (NYSE:BAK) is the least popular one with only 13 bullish hedge fund positions. Kansas City Southern (NYSE:KSU) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MLM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.