We can judge whether Jazz Pharmaceuticals plc – Ordinary Shares (NASDAQ:JAZZ) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, research shows that these picks historically outperformed the market when we factor in known risk factors.

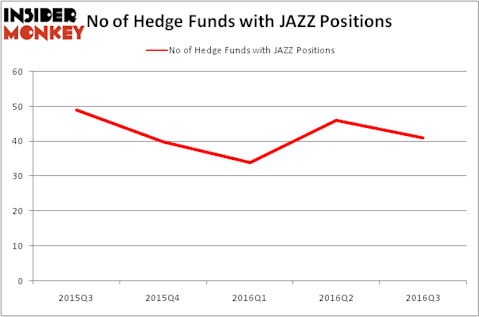

Jazz Pharmaceuticals plc – Ordinary Shares (NASDAQ:JAZZ) has experienced a decrease in hedge fund sentiment recently. JAZZ was in 41 hedge funds’ portfolios at the end of September. There were 46 hedge funds in our database with JAZZ holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as DexCom, Inc. (NASDAQ:DXCM), Liberty Global PLC LiLAC Class C (NASDAQ:LILAK), and Liberty Global PLC LiLAC Class A (NASDAQ:LILA) to gather more data points.

Follow Jazz Pharmaceuticals Plc (NASDAQ:JAZZ)

Follow Jazz Pharmaceuticals Plc (NASDAQ:JAZZ)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

How have hedgies been trading Jazz Pharmaceuticals plc – Ordinary Shares (NASDAQ:JAZZ)?

Heading into the fourth quarter of 2016, a total of 41 of the hedge funds tracked by Insider Monkey were long this stock, down by 11% from one quarter earlier. By comparison, 40 hedge funds held shares or bullish call options in JAZZ heading into this year. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Eric Bannasch’s Cadian Capital has the largest position in Jazz Pharmaceuticals plc – Ordinary Shares (NASDAQ:JAZZ), worth close to $159.3 million, amounting to 8.4% of its total 13F portfolio. Sitting at the No. 2 spot is Partner Fund Management, led by Christopher James, holding a $141.1 million position; 4.1% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that are bullish consist of Jim Simons’ Renaissance Technologies, Andreas Halvorsen’s Viking Global and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.