Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed over the past few years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that hedge funds do have great stock picking skills, so let’s take a glance at the smart money sentiment towards Expedia Group, Inc. (NASDAQ:EXPE).

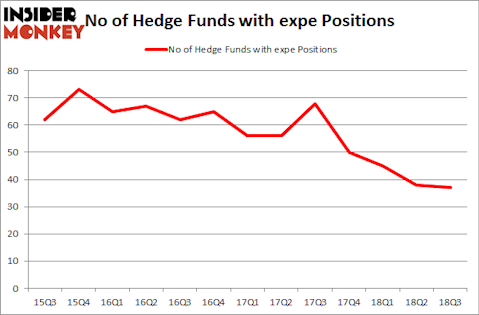

Is Expedia Group, Inc. (NASDAQ:EXPE) a bargain? Hedge funds are becoming less confident. The number of bullish hedge fund positions were trimmed by 1 lately. Our calculations also showed that expe isn’t among the 30 most popular stocks among hedge funds. EXPE was in 37 hedge funds’ portfolios at the end of September. There were 38 hedge funds in our database with EXPE positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action surrounding Expedia Group, Inc. (NASDAQ:EXPE).

How are hedge funds trading Expedia Group, Inc. (NASDAQ:EXPE)?

At Q3’s end, a total of 37 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -3% from one quarter earlier. By comparison, 50 hedge funds held shares or bullish call options in EXPE heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

More specifically, PAR Capital Management was the largest shareholder of Expedia Group, Inc. (NASDAQ:EXPE), with a stake worth $1.04 billion reported as of the end of September. Trailing PAR Capital Management was Senator Investment Group, which amassed a stake valued at $391.4 million. First Pacific Advisors LLC, Altimeter Capital Management, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Because Expedia Group, Inc. (NASDAQ:EXPE) has faced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there were a few hedge funds that slashed their full holdings by the end of the third quarter. At the top of the heap, Ryan Frick and Oliver Evans’s Dorsal Capital Management said goodbye to the largest investment of the “upper crust” of funds watched by Insider Monkey, valued at an estimated $72.1 million in stock, and John Lykouretzos’s Hoplite Capital Management was right behind this move, as the fund said goodbye to about $26.5 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 1 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks similar to Expedia Group, Inc. (NASDAQ:EXPE). We will take a look at Eversource Energy (NYSE:ES), Dollar Tree, Inc. (NASDAQ:DLTR), Ventas, Inc. (NYSE:VTR), and Dell Technologies Inc. (NASDAQ:DVMT). This group of stocks’ market valuations are closest to EXPE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ES | 19 | 708140 | 4 |

| DLTR | 53 | 1885624 | 5 |

| VTR | 15 | 224805 | 0 |

| DVMT | 61 | 6285474 | -5 |

| Average | 37 | 2276011 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37 hedge funds with bullish positions and the average amount invested in these stocks was $2.28 billion. That figure was $3.12 billion in EXPE’s case. Dell Technologies Inc. (NASDAQ:DVMT) is the most popular stock in this table. On the other hand Ventas, Inc. (NYSE:VTR) is the least popular one with only 15 bullish hedge fund positions. Expedia Group, Inc. (NASDAQ:EXPE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard DVMT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.