Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of EnerSys (NYSE:ENS).

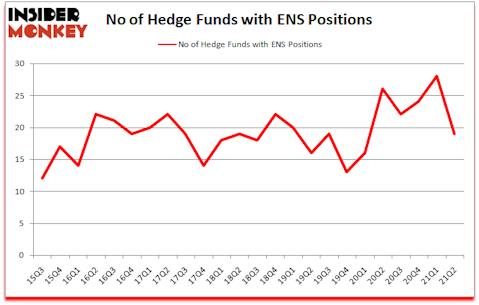

EnerSys (NYSE:ENS) investors should be aware of a decrease in hedge fund interest recently. EnerSys (NYSE:ENS) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 28. There were 28 hedge funds in our database with ENS holdings at the end of March. Our calculations also showed that ENS isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 185.4% since March 2017 and outperformed the S&P 500 ETFs by more than 79 percentage points (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Noam Gottesman of GLG Partners

With all of this in mind let’s take a glance at the key hedge fund action encompassing EnerSys (NYSE:ENS).

Do Hedge Funds Think ENS Is A Good Stock To Buy Now?

At the end of June, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -32% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in ENS over the last 24 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in EnerSys (NYSE:ENS) was held by Shellback Capital, which reported holding $47.3 million worth of stock at the end of June. It was followed by ACK Asset Management with a $22.2 million position. Other investors bullish on the company included Hill City Capital, AQR Capital Management, and GLG Partners. In terms of the portfolio weights assigned to each position ACK Asset Management allocated the biggest weight to EnerSys (NYSE:ENS), around 8.18% of its 13F portfolio. Hill City Capital is also relatively very bullish on the stock, dishing out 6.52 percent of its 13F equity portfolio to ENS.

Judging by the fact that EnerSys (NYSE:ENS) has witnessed falling interest from the aggregate hedge fund industry, it’s safe to say that there were a few money managers that elected to cut their positions entirely last quarter. At the top of the heap, Len Kipp and Xavier Majic’s Maple Rock Capital dropped the biggest investment of all the hedgies watched by Insider Monkey, comprising close to $8.2 million in stock, and Paul Tudor Jones’s Tudor Investment Corp was right behind this move, as the fund dumped about $4 million worth. These bearish behaviors are important to note, as total hedge fund interest fell by 9 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as EnerSys (NYSE:ENS) but similarly valued. We will take a look at Axis Capital Holdings Limited (NYSE:AXS), JBG SMITH Properties (NYSE:JBGS), Tegna Inc (NYSE:TGNA), Arena Pharmaceuticals, Inc. (NASDAQ:ARNA), Univar Solutions Inc (NYSE:UNVR), Portland General Electric Company (NYSE:POR), and Envestnet Inc (NYSE:ENV). This group of stocks’ market values resemble ENS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AXS | 19 | 609412 | -4 |

| JBGS | 17 | 197535 | 6 |

| TGNA | 18 | 347074 | -2 |

| ARNA | 34 | 756649 | 1 |

| UNVR | 28 | 704708 | 3 |

| POR | 21 | 70216 | 0 |

| ENV | 17 | 329409 | -1 |

| Average | 22 | 430715 | 0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $431 million. That figure was $202 million in ENS’s case. Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) is the most popular stock in this table. On the other hand JBG SMITH Properties (NYSE:JBGS) is the least popular one with only 17 bullish hedge fund positions. EnerSys (NYSE:ENS) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for ENS is 22.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and surpassed the market again by 1.6 percentage points. Unfortunately ENS wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); ENS investors were disappointed as the stock returned -21.3% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Enersys (NYSE:ENS)

Follow Enersys (NYSE:ENS)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Communication Stocks to Buy Now

- 10 Best Growth Stocks for the Next 10 Years

- 15 Most Popular Instand Messaging Apps

Disclosure: None. This article was originally published at Insider Monkey.