Is Career Education Corp. (NASDAQ:CECO) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They sometimes fail miserably but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

Is Career Education Corp. (NASDAQ:CECO) an excellent investment today? The smart money is getting less bullish. The number of long hedge fund positions retreated by 3 recently. Our calculations also showed that CECO isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are dozens of signals stock traders use to grade publicly traded companies. Some of the most underrated signals are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can trounce the market by a solid margin (see the details here).

We’re going to take a look at the new hedge fund action regarding Career Education Corp. (NASDAQ:CECO).

What does the smart money think about Career Education Corp. (NASDAQ:CECO)?

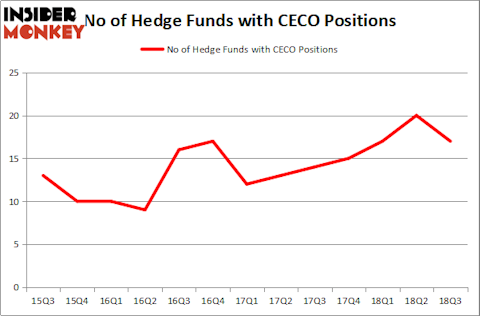

Heading into the fourth quarter of 2018, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -15% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CECO over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Career Education Corp. (NASDAQ:CECO), with a stake worth $65.4 million reported as of the end of September. Trailing Renaissance Technologies was Tenzing Global Investors, which amassed a stake valued at $20.2 million. D E Shaw, Lonestar Capital Management, and Driehaus Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Because Career Education Corp. (NASDAQ:CECO) has experienced bearish sentiment from the smart money, we can see that there exists a select few money managers that slashed their positions entirely by the end of the third quarter. Interestingly, Nathaniel August’s Mangrove Partners sold off the largest investment of the 700 funds followed by Insider Monkey, totaling an estimated $29.1 million in stock, and Thomas Bailard’s Bailard Inc was right behind this move, as the fund cut about $0.3 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 3 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Career Education Corp. (NASDAQ:CECO) but similarly valued. These stocks are Eagle Pharmaceuticals Inc (NASDAQ:EGRX), Encore Wire Corporation (NASDAQ:WIRE), Navigant Consulting, Inc. (NYSE:NCI), and Nuveen New York AMT-Free Quality Municipal Income Fund (NYSE:NRK). This group of stocks’ market valuations match CECO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EGRX | 19 | 249747 | -1 |

| WIRE | 13 | 33120 | -1 |

| NCI | 15 | 89666 | 0 |

| NRK | 2 | 2157 | -2 |

| Average | 12.25 | 93673 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $94 million. That figure was $156 million in CECO’s case. Eagle Pharmaceuticals Inc (NASDAQ:EGRX) is the most popular stock in this table. On the other hand Nuveen New York AMT-Free Quality Municipal Income Fund (NYSE:NRK) is the least popular one with only 2 bullish hedge fund positions. Career Education Corp. (NASDAQ:CECO) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard EGRX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.