Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by elite investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

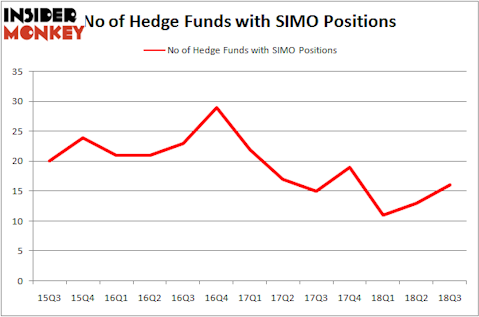

Silicon Motion Technology Corp. (NASDAQ:SIMO) was in 16 hedge funds’ portfolios at the end of September. SIMO has seen an increase in hedge fund sentiment recently. There were 13 hedge funds in our database with SIMO holdings at the end of the previous quarter. Our calculations also showed that SIMO isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are assumed to be unimportant, outdated financial vehicles of the past. While there are greater than 8,000 funds with their doors open at the moment, We look at the elite of this club, around 700 funds. Most estimates calculate that this group of people direct bulk of the hedge fund industry’s total capital, and by watching their inimitable investments, Insider Monkey has figured out many investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s analyze the new hedge fund action surrounding Silicon Motion Technology Corp. (NASDAQ:SIMO).

How are hedge funds trading Silicon Motion Technology Corp. (NASDAQ:SIMO)?

Heading into the fourth quarter of 2018, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 23% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in SIMO over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Cardinal Capital was the largest shareholder of Silicon Motion Technology Corp. (NASDAQ:SIMO), with a stake worth $89.6 million reported as of the end of September. Trailing Cardinal Capital was Citadel Investment Group, which amassed a stake valued at $40.2 million. Royce & Associates, Garelick Capital Partners, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, specific money managers have jumped into Silicon Motion Technology Corp. (NASDAQ:SIMO) headfirst. Garelick Capital Partners, managed by Bruce Garelick, created the most valuable position in Silicon Motion Technology Corp. (NASDAQ:SIMO). Garelick Capital Partners had $20.4 million invested in the company at the end of the quarter. Joe DiMenna’s ZWEIG DIMENNA PARTNERS also initiated a $5.8 million position during the quarter. The following funds were also among the new SIMO investors: Dmitry Balyasny’s Balyasny Asset Management, Ernest Chow and Jonathan Howe’s Sensato Capital Management, and David Costen Haley’s HBK Investments.

Let’s now review hedge fund activity in other stocks similar to Silicon Motion Technology Corp. (NASDAQ:SIMO). We will take a look at Vector Group Ltd (NYSE:VGR), Cars.com Inc. (NYSE:CARS), Greenbrier Companies Inc (NYSE:GBX), and HNI Corp (NYSE:HNI). This group of stocks’ market caps resemble SIMO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VGR | 18 | 174166 | 1 |

| CARS | 30 | 447879 | 7 |

| GBX | 15 | 105838 | -7 |

| HNI | 10 | 25685 | 0 |

| Average | 18.25 | 188392 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $188 million. That figure was $221 million in SIMO’s case. Cars.com Inc. (NYSE:CARS) is the most popular stock in this table. On the other hand HNI Corp (NYSE:HNI) is the least popular one with only 10 bullish hedge fund positions. Silicon Motion Technology Corp. (NASDAQ:SIMO) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CARS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.