There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze ICU Medical, Inc. (NASDAQ:ICUI).

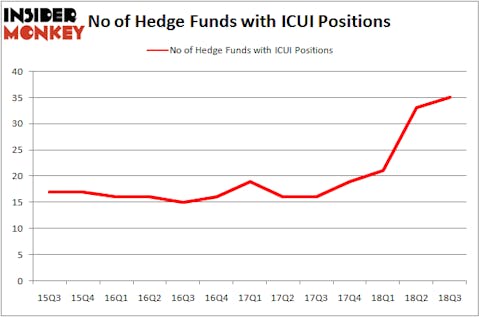

Is ICU Medical, Inc. (NASDAQ:ICUI) a splendid investment right now? Hedge funds are betting on the stock. The number of bullish hedge fund positions moved up by 2 lately. Our calculations also showed that ICUI isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most stock holders, hedge funds are viewed as unimportant, old investment tools of the past. While there are greater than 8,000 funds in operation today, Our experts look at the bigwigs of this club, about 700 funds. These investment experts direct the majority of all hedge funds’ total asset base, and by keeping an eye on their unrivaled picks, Insider Monkey has come up with a number of investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s go over the recent hedge fund action surrounding ICU Medical, Inc. (NASDAQ:ICUI).

How have hedgies been trading ICU Medical, Inc. (NASDAQ:ICUI)?

At Q3’s end, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from the second quarter of 2018. On the other hand, there were a total of 19 hedge funds with a bullish position in ICUI at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in ICU Medical, Inc. (NASDAQ:ICUI), which was worth $152.6 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $59.1 million worth of shares. Moreover, Redmile Group, Point72 Asset Management, and Marshall Wace LLP were also bullish on ICU Medical, Inc. (NASDAQ:ICUI), allocating a large percentage of their portfolios to this stock.

Now, key money managers were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the most valuable position in ICU Medical, Inc. (NASDAQ:ICUI). Marshall Wace LLP had $43.3 million invested in the company at the end of the quarter. Arthur B Cohen and Joseph Healey’s Healthcor Management LP also made a $2.9 million investment in the stock during the quarter. The other funds with brand new ICUI positions are Brandon Haley’s Holocene Advisors, Benjamin A. Smith’s Laurion Capital Management, and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s now take a look at hedge fund activity in other stocks similar to ICU Medical, Inc. (NASDAQ:ICUI). We will take a look at Ligand Pharmaceuticals Inc. (NASDAQ:LGND), Gentex Corporation (NASDAQ:GNTX), Murphy Oil Corporation (NYSE:MUR), and First American Financial Corp (NYSE:FAF). This group of stocks’ market valuations are similar to ICUI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LGND | 28 | 544013 | 6 |

| GNTX | 27 | 312500 | 1 |

| MUR | 23 | 363595 | 0 |

| FAF | 33 | 620242 | 7 |

| Average | 27.75 | 460088 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.75 hedge funds with bullish positions and the average amount invested in these stocks was $460 million. That figure was $567 million in ICUI’s case. First American Financial Corp (NYSE:FAF) is the most popular stock in this table. On the other hand Murphy Oil Corporation (NYSE:MUR) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks ICU Medical, Inc. (NASDAQ:ICUI) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.