Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the second quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 6 years and analyze what the smart money thinks of Domtar Corporation (NYSE:UFS) based on that data.

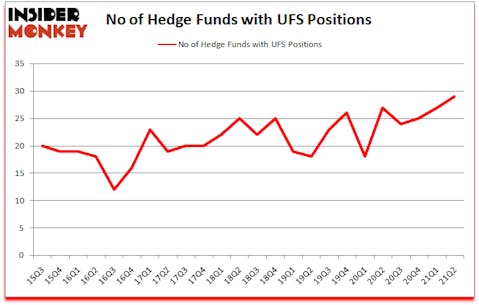

Domtar Corporation (NYSE:UFS) has seen an increase in support from the world’s most elite money managers recently. Domtar Corporation (NYSE:UFS) was in 29 hedge funds’ portfolios at the end of June. The all time high for this statistic was previously 27. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 27 hedge funds in our database with UFS holdings at the end of March. Our calculations also showed that UFS isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

At the moment there are a multitude of gauges stock traders can use to value stocks. A duo of the most innovative gauges are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the elite money managers can trounce the S&P 500 by a superb margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Matthew Halbower of Pentwater Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let’s take a glance at the fresh hedge fund action regarding Domtar Corporation (NYSE:UFS).

Do Hedge Funds Think UFS Is A Good Stock To Buy Now?

At the end of June, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from one quarter earlier. On the other hand, there were a total of 27 hedge funds with a bullish position in UFS a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Magnetar Capital, managed by Alec Litowitz and Ross Laser, holds the biggest position in Domtar Corporation (NYSE:UFS). Magnetar Capital has a $119.1 million position in the stock, comprising 1.1% of its 13F portfolio. Sitting at the No. 2 spot is Millennium Management, managed by Israel Englander, which holds a $47.8 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other professional money managers that are bullish include Clint Carlson’s Carlson Capital, John Orrico’s Water Island Capital and Robert Emil Zoellner’s Alpine Associates. In terms of the portfolio weights assigned to each position Carlson Capital allocated the biggest weight to Domtar Corporation (NYSE:UFS), around 2.17% of its 13F portfolio. Sandbar Asset Management is also relatively very bullish on the stock, designating 2.03 percent of its 13F equity portfolio to UFS.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Magnetar Capital, managed by Alec Litowitz and Ross Laser, assembled the largest position in Domtar Corporation (NYSE:UFS). Magnetar Capital had $119.1 million invested in the company at the end of the quarter. John Orrico’s Water Island Capital also initiated a $34.7 million position during the quarter. The other funds with new positions in the stock are Robert Emil Zoellner’s Alpine Associates, Dmitry Balyasny’s Balyasny Asset Management, and Matthew Halbower’s Pentwater Capital Management.

Let’s check out hedge fund activity in other stocks similar to Domtar Corporation (NYSE:UFS). We will take a look at SPX Corporation (NYSE:SPXC), Vivint Smart Home, Inc. (NYSE:VVNT), SPX FLOW, Inc. (NYSE:FLOW), Axos Financial, Inc. (NYSE:AX), Criteo SA (NASDAQ:CRTO), ThredUp Inc. (NASDAQ:TDUP), and Masonite International Corp (NYSE:DOOR). This group of stocks’ market values match UFS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SPXC | 11 | 35832 | 0 |

| VVNT | 5 | 32700 | -2 |

| FLOW | 14 | 198812 | -2 |

| AX | 11 | 34859 | -2 |

| CRTO | 16 | 188013 | 0 |

| TDUP | 13 | 319913 | 1 |

| DOOR | 24 | 309932 | -7 |

| Average | 13.4 | 160009 | -1.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.4 hedge funds with bullish positions and the average amount invested in these stocks was $160 million. That figure was $368 million in UFS’s case. Masonite International Corp (NYSE:DOOR) is the most popular stock in this table. On the other hand Vivint Smart Home, Inc. (NYSE:VVNT) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Domtar Corporation (NYSE:UFS) is more popular among hedge funds. Our overall hedge fund sentiment score for UFS is 87. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24.9% in 2021 through October 15th and still beat the market by 4.5 percentage points. Unfortunately UFS wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on UFS were disappointed as the stock returned 0.3% since the end of the second quarter (through 10/15) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Domtar Corp (NYSE:UFS)

Follow Domtar Corp (NYSE:UFS)

Receive real-time insider trading and news alerts

Suggested Articles:

- Top 25 Places to Visit in the US

- 15 Most Valuable Asian Companies

- 10 Best Junior Gold Mining Stocks To Buy

Disclosure: None. This article was originally published at Insider Monkey.