Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in DENTSPLY SIRONA Inc. (NASDAQ:XRAY)? The smart money sentiment can provide an answer to this question.

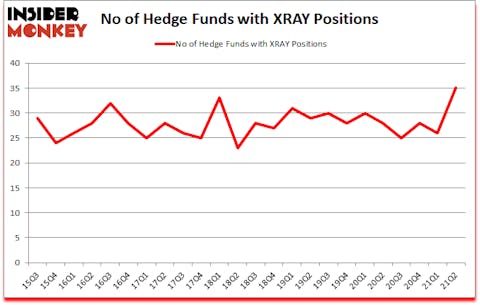

DENTSPLY SIRONA Inc. (NASDAQ:XRAY) investors should be aware of an increase in hedge fund interest lately. DENTSPLY SIRONA Inc. (NASDAQ:XRAY) was in 35 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic was previously 33. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 26 hedge funds in our database with XRAY holdings at the end of March. Our calculations also showed that XRAY isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Robert Pohly of Samlyn Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, we like undervalued, EBITDA-positive growth stocks, so we are checking out stock pitches like this emerging biotech stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to take a look at the new hedge fund action encompassing DENTSPLY SIRONA Inc. (NASDAQ:XRAY).

Do Hedge Funds Think XRAY Is A Good Stock To Buy Now?

Heading into the third quarter of 2021, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 35% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards XRAY over the last 24 quarters. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

More specifically, 0 was the largest shareholder of DENTSPLY SIRONA Inc. (NASDAQ:XRAY), with a stake worth $443 million reported as of the end of June. Trailing Generation Investment Management was Balyasny Asset Management, which amassed a stake valued at $88.3 million. Millennium Management, Citadel Investment Group, and Renaissance Technologies were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Generation Investment Management allocated the biggest weight to DENTSPLY SIRONA Inc. (NASDAQ:XRAY), around 1.84% of its 13F portfolio. Endurant Capital Management is also relatively very bullish on the stock, designating 1.81 percent of its 13F equity portfolio to XRAY.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Balyasny Asset Management, managed by Dmitry Balyasny, established the biggest position in DENTSPLY SIRONA Inc. (NASDAQ:XRAY). Balyasny Asset Management had $88.3 million invested in the company at the end of the quarter. Robert Pohly’s Samlyn Capital also initiated a $22.5 million position during the quarter. The other funds with brand new XRAY positions are Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management, Vishal Saluja and Pham Quang’s Endurant Capital Management, and Greg Eisner’s Engineers Gate Manager.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as DENTSPLY SIRONA Inc. (NASDAQ:XRAY) but similarly valued. We will take a look at Vipshop Holdings Limited (NYSE:VIPS), Fortune Brands Home & Security Inc (NYSE:FBHS), Crown Holdings, Inc. (NYSE:CCK), IAC/InterActiveCorp (NASDAQ:IAC), Tuya Inc. (NYSE:TUYA), RLX Technology Inc. (NYSE:RLX), and CureVac N.V. (NASDAQ:CVAC). All of these stocks’ market caps are similar to XRAY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VIPS | 36 | 1306788 | -18 |

| FBHS | 28 | 411937 | 5 |

| CCK | 53 | 1981122 | -7 |

| IAC | 50 | 1226152 | -13 |

| TUYA | 8 | 224184 | -7 |

| RLX | 12 | 192836 | -11 |

| CVAC | 12 | 24977 | 3 |

| Average | 28.4 | 766857 | -6.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.4 hedge funds with bullish positions and the average amount invested in these stocks was $767 million. That figure was $1110 million in XRAY’s case. Crown Holdings, Inc. (NYSE:CCK) is the most popular stock in this table. On the other hand Tuya Inc. (NYSE:TUYA) is the least popular one with only 8 bullish hedge fund positions. DENTSPLY SIRONA Inc. (NASDAQ:XRAY) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for XRAY is 70. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 21.8% in 2021 through October 11th and beat the market again by 4.4 percentage points. Unfortunately XRAY wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on XRAY were disappointed as the stock returned -9.5% since the end of June (through 10/11) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Dentsply Sirona Inc. (NASDAQ:XRAY)

Follow Dentsply Sirona Inc. (NASDAQ:XRAY)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Best Clean Energy Stocks to Invest In

- 10 Best Bitcoin Stocks to Buy Now

- 10 Biggest Companies That Were Dropped From the Dow Jones Industrial Average (DJIA)

Disclosure: None. This article was originally published at Insider Monkey.