Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

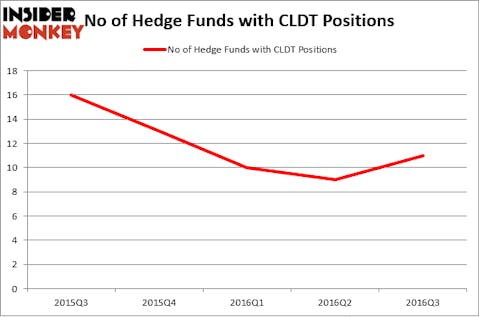

Chatham Lodging Trust (NYSE:CLDT) has seen an increase in enthusiasm from smart money of late. There were 9 hedge funds in our database with CLDT holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as WL Ross Holding Corp (NASDAQ:NXEO), TIER REIT Inc (NYSE:TIER), and Virtusa Corporation (NASDAQ:VRTU) to gather more data points.

Follow Chatham Lodging Trust (NYSE:CLDT)

Follow Chatham Lodging Trust (NYSE:CLDT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Kaspars Grinvalds/Shutterstock.com

With all of this in mind, let’s go over the recent action regarding Chatham Lodging Trust (NYSE:CLDT).

What does the smart money think about Chatham Lodging Trust (NYSE:CLDT)?

Heading into the fourth quarter of 2016, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, an increase of 22% from the previous quarter. By comparison, 13 hedge funds held shares or bullish call options in CLDT heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Forward Management, led by J. Alan Reid, Jr., holds the biggest position in Chatham Lodging Trust (NYSE:CLDT). Forward Management has a $37.1 million position in the stock, comprising 2.8% of its 13F portfolio. The second most bullish fund manager is AEW Capital Management, led by Jeffrey Furber, which holds a $30.9 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish comprise Renaissance Technologies, one of the largest hedge funds in the world, Daniel Beltzman and Gergory Smith’s Birch Run Capital and Cliff Asness’ AQR Capital Management. We should note that Forward Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, key hedge funds have been driving this bullishness. Balyasny Asset Management, led by Dmitry Balyasny, created the biggest position in Chatham Lodging Trust (NYSE:CLDT). Balyasny Asset Management had $2.1 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.7 million position during the quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Chatham Lodging Trust (NYSE:CLDT) but similarly valued. We will take a look at WL Ross Holding Corp (NASDAQ:NXEO), TIER REIT Inc (NYSE:TIER), Virtusa Corporation (NASDAQ:VRTU), and CEVA, Inc. (NASDAQ:CEVA). This group of stocks’ market valuations resemble CLDT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NXEO | 21 | 201564 | 1 |

| TIER | 11 | 41989 | 1 |

| VRTU | 7 | 18383 | -4 |

| CEVA | 17 | 112170 | 2 |

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $94 million. That figure was $106 million in CLDT’s case. WL Ross Holding Corp (NASDAQ:NXEO) is the most popular stock in this table. On the other hand Virtusa Corporation (NASDAQ:VRTU) is the least popular one with only 7 bullish hedge fund positions. Chatham Lodging Trust (NYSE:CLDT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NXEO might be a better candidate to consider taking a long position in.

Disclosure: none