Is Cambrex Corporation (NYSE:CBM) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy league graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

Is Cambrex Corporation (NYSE:CBM) the right investment to pursue these days? Hedge funds are betting on the stock. The number of bullish hedge fund positions inched up by 2 lately. Our calculations also showed that CBM isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a look at the new hedge fund action regarding Cambrex Corporation (NYSE:CBM).

What have hedge funds been doing with Cambrex Corporation (NYSE:CBM)?

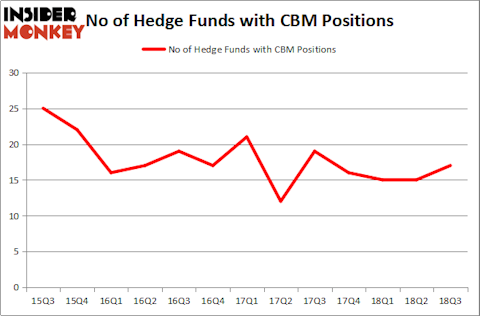

Heading into the fourth quarter of 2018, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in CBM over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, GLG Partners was the largest shareholder of Cambrex Corporation (NYSE:CBM), with a stake worth $9.1 million reported as of the end of September. Trailing GLG Partners was Portolan Capital Management, which amassed a stake valued at $6.9 million. Marshall Wace LLP, AlphaOne Capital Partners, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, specific money managers were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the biggest position in Cambrex Corporation (NYSE:CBM). Marshall Wace LLP had $5.8 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $1.7 million position during the quarter. The other funds with brand new CBM positions are Alec Litowitz and Ross Laser’s Magnetar Capital, Mike Vranos’s Ellington, and Jeffrey Talpins’s Element Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Cambrex Corporation (NYSE:CBM) but similarly valued. These stocks are Compass Minerals International, Inc. (NYSE:CMP), Dominion Energy Midstream Partners, LP (NYSE:DM), ExlService Holdings, Inc. (NASDAQ:EXLS), and Independent Bank Corp (NASDAQ:INDB). This group of stocks’ market valuations resemble CBM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMP | 11 | 117405 | -1 |

| DM | 4 | 12285 | 3 |

| EXLS | 10 | 58943 | -1 |

| INDB | 7 | 13638 | 1 |

| Average | 8 | 50568 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $51 million. That figure was $47 million in CBM’s case. Compass Minerals International, Inc. (NYSE:CMP) is the most popular stock in this table. On the other hand Dominion Energy Midstream Partners, LP (NYSE:DM) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Cambrex Corporation (NYSE:CBM) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.