As we already know from media reports and hedge fund investor letters, many hedge funds lost money in October, blaming macroeconomic conditions and unpredictable events that hit several sectors, with healthcare among them. Nevertheless, most investors decided to stick to their bullish theses and their long-term focus allows us to profit from the recent declines. In particular, let’s take a look at what hedge funds think about Bio-Rad Laboratories, Inc. (NYSE:BIO) in this article.

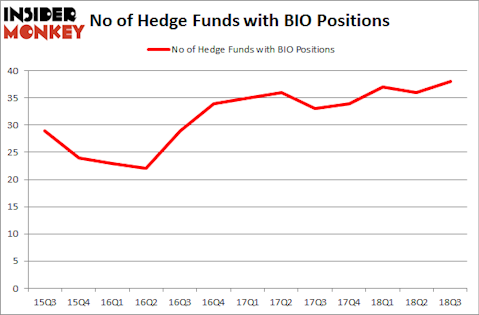

Is Bio-Rad Laboratories, Inc. (NYSE:BIO) a sound stock to buy now? The best stock pickers are getting more optimistic. The number of bullish hedge fund bets rose by 2 recently. Our calculations also showed that BIO isn’t among the 30 most popular stocks among hedge funds.

To most traders, hedge funds are viewed as underperforming, outdated investment tools of yesteryear. While there are over 8,000 funds in operation today, Our researchers choose to focus on the upper echelon of this group, approximately 700 funds. Most estimates calculate that this group of people manage the majority of the hedge fund industry’s total capital, and by observing their highest performing stock picks, Insider Monkey has uncovered a few investment strategies that have historically defeated the market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to review the key hedge fund action encompassing Bio-Rad Laboratories, Inc. (NYSE:BIO).

What have hedge funds been doing with Bio-Rad Laboratories, Inc. (NYSE:BIO)?

At Q3’s end, a total of 38 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from one quarter earlier. On the other hand, there were a total of 34 hedge funds with a bullish position in BIO at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Millennium Management was the largest shareholder of Bio-Rad Laboratories, Inc. (NYSE:BIO), with a stake worth $118.3 million reported as of the end of September. Trailing Millennium Management was Fisher Asset Management, which amassed a stake valued at $80.2 million. Ariel Investments, Polar Capital, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Bodenholm Capital, managed by Per Johanssoná, initiated the largest position in Bio-Rad Laboratories, Inc. (NYSE:BIO). Bodenholm Capital had $32.5 million invested in the company at the end of the quarter. Brad Farber’s Atika Capital also initiated a $5.2 million position during the quarter. The other funds with brand new BIO positions are Arthur B Cohen and Joseph Healey’s Healthcor Management LP, Joel Greenblatt’s Gotham Asset Management, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Bio-Rad Laboratories, Inc. (NYSE:BIO) but similarly valued. These stocks are Everest Re Group Ltd (NYSE:RE), Federal Realty Investment Trust (NYSE:FRT), Parsley Energy Inc (NYSE:PE), and Tableau Software Inc (NYSE:DATA). This group of stocks’ market values are similar to BIO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RE | 14 | 486625 | -6 |

| FRT | 21 | 252350 | 1 |

| PE | 44 | 1568881 | 5 |

| DATA | 37 | 2137998 | 5 |

| Average | 29 | 1111464 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1.11 billion. That figure was $811 million in BIO’s case. Parsley Energy Inc (NYSE:PE) is the most popular stock in this table. On the other hand Everest Re Group Ltd (NYSE:RE) is the least popular one with only 14 bullish hedge fund positions. Bio-Rad Laboratories, Inc. (NYSE:BIO) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PE might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.