Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged during the first quarter. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 40% and 25% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the first 5 months of 2019 and outperformed the broader market benchmark by 6.6 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

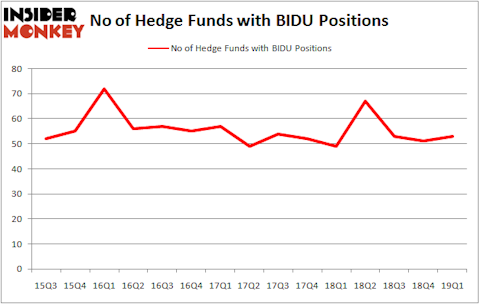

Baidu, Inc. (NASDAQ:BIDU) has experienced an increase in support from the world’s most elite money managers lately. BIDU was in 53 hedge funds’ portfolios at the end of the first quarter of 2019. There were 51 hedge funds in our database with BIDU positions at the end of the previous quarter. Our calculations also showed that BIDU isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a peek at the key hedge fund action regarding Baidu, Inc. (NASDAQ:BIDU).

How are hedge funds trading Baidu, Inc. (NASDAQ:BIDU)?

At the end of the first quarter, a total of 53 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from one quarter earlier. On the other hand, there were a total of 49 hedge funds with a bullish position in BIDU a year ago. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, First Pacific Advisors LLC, managed by Robert Rodriguez and Steven Romick, holds the number one position in Baidu, Inc. (NASDAQ:BIDU). First Pacific Advisors LLC has a $397.9 million position in the stock, comprising 3.5% of its 13F portfolio. On First Pacific Advisors LLC’s heels is Fisher Asset Management, managed by Ken Fisher, which holds a $268.4 million position; 0.4% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors that hold long positions include John W. Rogers’s Ariel Investments, Anthony Bozza’s Lakewood Capital Management and John Overdeck and David Siegel’s Two Sigma Advisors.

Now, some big names were leading the bulls’ herd. Millennium Management, managed by Israel Englander, assembled the most outsized call position in Baidu, Inc. (NASDAQ:BIDU). Millennium Management had $36.5 million invested in the company at the end of the quarter. Leon Shaulov’s Maplelane Capital also initiated a $33 million position during the quarter. The following funds were also among the new BIDU investors: David Kowitz and Sheldon Kasowitz’s Indus Capital, Richard Driehaus’s Driehaus Capital, and Manoneet Singh’s Kavi Asset Management.

Let’s now review hedge fund activity in other stocks similar to Baidu, Inc. (NASDAQ:BIDU). These stocks are Lloyds Banking Group PLC (NYSE:LYG), The Charles Schwab Corp (NYSE:SCHW), Simon Property Group, Inc (NYSE:SPG), and The PNC Financial Services Group Inc. (NYSE:PNC). All of these stocks’ market caps match BIDU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LYG | 8 | 43491 | -2 |

| SCHW | 51 | 3140234 | 5 |

| SPG | 28 | 897496 | 2 |

| PNC | 40 | 2516367 | 2 |

| Average | 31.75 | 1649397 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.75 hedge funds with bullish positions and the average amount invested in these stocks was $1649 million. That figure was $2735 million in BIDU’s case. The Charles Schwab Corp (NYSE:SCHW) is the most popular stock in this table. On the other hand Lloyds Banking Group PLC (NYSE:LYG) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Baidu, Inc. (NASDAQ:BIDU) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately BIDU wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BIDU were disappointed as the stock returned -32.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.