It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 7% during October and average hedge fund losing about 3%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by about 4 percentage points during the first half of Q4, as investors fled less-known quantities for safe havens. This was the case with hedge funds, who we heard were pulling money from the market amid the volatility, which included money from small-cap stocks, which they invest in at a higher rate than other investors. This action contributed to the greater decline in these stocks during the tumultuous period. We will study how this market volatility affected their sentiment towards Annaly Capital Management, Inc. (NYSE:NLY) during the quarter below.

Annaly Capital Management, Inc. (NYSE:NLY) has experienced an increase in activity from the world’s largest hedge funds lately. Our calculations also showed that NLY isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are a large number of gauges stock traders put to use to evaluate stocks. A pair of the most innovative gauges are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the elite investment managers can outclass the S&P 500 by a solid amount (see the details here).

We’re going to analyze the recent hedge fund action regarding Annaly Capital Management, Inc. (NYSE:NLY).

What does the smart money think about Annaly Capital Management, Inc. (NYSE:NLY)?

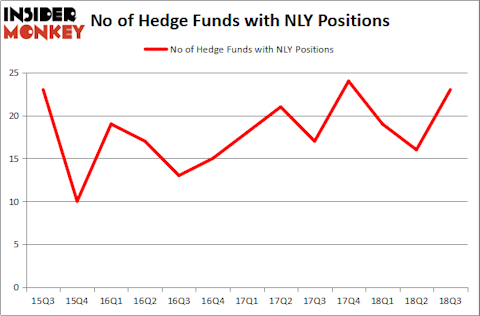

At Q3’s end, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 44% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards NLY over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the largest position in Annaly Capital Management, Inc. (NYSE:NLY). Citadel Investment Group has a $122.1 million position in the stock, comprising 0.1% of its 13F portfolio. The second most bullish fund manager is Two Sigma Advisors, led by John Overdeck and David Siegel, holding a $55.1 million position; 0.1% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Jim Simons’s Renaissance Technologies and Dmitry Balyasny’s Balyasny Asset Management.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the largest position in Annaly Capital Management, Inc. (NYSE:NLY). Arrowstreet Capital had $48.6 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $15.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Jeffrey Talpins’s Element Capital Management, David Costen Haley’s HBK Investments, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Annaly Capital Management, Inc. (NYSE:NLY) but similarly valued. These stocks are Diamondback Energy Inc (NASDAQ:FANG), Alexandria Real Estate Equities Inc (NYSE:ARE), Conagra Brands, Inc. (NYSE:CAG), and Rollins, Inc. (NYSE:ROL). This group of stocks’ market values are closest to NLY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FANG | 37 | 1325118 | 9 |

| ARE | 18 | 354276 | -5 |

| CAG | 38 | 1060012 | 7 |

| ROL | 17 | 287432 | 1 |

| Average | 27.5 | 756710 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.5 hedge funds with bullish positions and the average amount invested in these stocks was $757 million. That figure was $347 million in NLY’s case. Conagra Brands, Inc. (NYSE:CAG) is the most popular stock in this table. On the other hand Rollins, Inc. (NYSE:ROL) is the least popular one with only 17 bullish hedge fund positions. Annaly Capital Management, Inc. (NYSE:NLY) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CAG might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.