Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed over the past few years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that hedge funds do have great stock picking skills, so let’s take a glance at the smart money sentiment towards Akebia Therapeutics Inc (NASDAQ:AKBA).

Is Akebia Therapeutics Inc (NASDAQ:AKBA) worth your attention right now? Prominent investors are in an optimistic mood. The number of long hedge fund bets moved up by 2 lately. Our calculations also showed that AKBA isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to review the fresh hedge fund action encompassing Akebia Therapeutics Inc (NASDAQ:AKBA).

What have hedge funds been doing with Akebia Therapeutics Inc (NASDAQ:AKBA)?

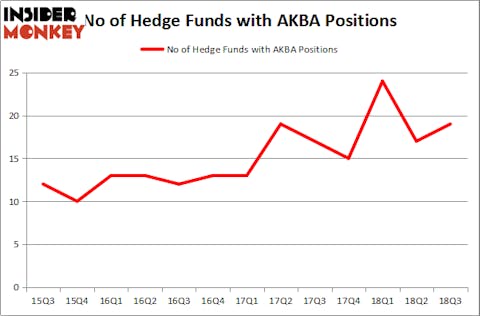

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 12% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AKBA over the last 13 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Wilmot B. Harkey and Daniel Mack’s Nantahala Capital Management has the largest position in Akebia Therapeutics Inc (NASDAQ:AKBA), worth close to $41.7 million, amounting to 1.1% of its total 13F portfolio. Coming in second is Joseph Edelman of Perceptive Advisors, with a $21.6 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism include Jim Simons’s Renaissance Technologies, David Abrams’s Abrams Capital Management and Ken Griffin’s Citadel Investment Group.

As one would reasonably expect, some big names were breaking ground themselves. Abrams Capital Management, managed by David Abrams, created the largest position in Akebia Therapeutics Inc (NASDAQ:AKBA). Abrams Capital Management had $9.9 million invested in the company at the end of the quarter. David Rosen’s Rubric Capital Management also made a $2.7 million investment in the stock during the quarter. The following funds were also among the new AKBA investors: Steve Cohen’s Point72 Asset Management, Peter Muller’s PDT Partners, and Murray Stahl’s Horizon Asset Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Akebia Therapeutics Inc (NASDAQ:AKBA) but similarly valued. We will take a look at Vishay Precision Group Inc (NYSE:VPG), Waterstone Financial, Inc. (NASDAQ:WSBF), Pure Acquisition Corp. (NASDAQ:PACQ), and Zymeworks Inc. (NYSE:ZYME). This group of stocks’ market values match AKBA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VPG | 15 | 135276 | -1 |

| WSBF | 9 | 83269 | -2 |

| PACQ | 19 | 109440 | 0 |

| ZYME | 13 | 95045 | 1 |

| Average | 14 | 105758 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $106 million. That figure was $122 million in AKBA’s case. Pure Acquisition Corp. (NASDAQ:PACQ) is the most popular stock in this table. On the other hand Waterstone Financial, Inc. (NASDAQ:WSBF) is the least popular one with only 9 bullish hedge fund positions. Akebia Therapeutics Inc (NASDAQ:AKBA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PACQ might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.