Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 900 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Unilever PLC (NYSE:UL) in this article.

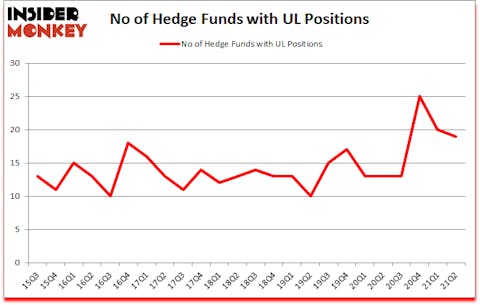

Is Unilever PLC (NYSE:UL) ready to rally soon? Investors who are in the know were taking a pessimistic view. The number of long hedge fund positions decreased by 1 in recent months. Unilever PLC (NYSE:UL) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 25. Our calculations also showed that UL isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 20 hedge funds in our database with UL positions at the end of the first quarter.

At the moment there are a multitude of tools investors put to use to evaluate their stock investments. A duo of the most innovative tools are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the top money managers can trounce their index-focused peers by a significant amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Now let’s take a glance at the recent hedge fund action surrounding Unilever PLC (NYSE:UL).

Do Hedge Funds Think UL Is A Good Stock To Buy Now?

At the end of June, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from the first quarter of 2020. By comparison, 13 hedge funds held shares or bullish call options in UL a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Gardner Russo & Gardner was the largest shareholder of Unilever PLC (NYSE:UL), with a stake worth $569.5 million reported as of the end of June. Trailing Gardner Russo & Gardner was Fisher Asset Management, which amassed a stake valued at $134.5 million. Citadel Investment Group, Renaissance Technologies, and Levin Easterly Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Pittencrieff Partners – Gabalex Capital allocated the biggest weight to Unilever PLC (NYSE:UL), around 5.5% of its 13F portfolio. Gardner Russo & Gardner is also relatively very bullish on the stock, setting aside 4.81 percent of its 13F equity portfolio to UL.

Judging by the fact that Unilever PLC (NYSE:UL) has faced declining sentiment from the smart money, it’s safe to say that there exists a select few funds who sold off their full holdings last quarter. It’s worth mentioning that Alexander Mitchell’s Scopus Asset Management dumped the biggest investment of the 750 funds tracked by Insider Monkey, worth an estimated $47.4 million in stock. D. E. Shaw’s fund, D E Shaw, also dropped its stock, about $29.5 million worth. These transactions are important to note, as total hedge fund interest fell by 1 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to Unilever PLC (NYSE:UL). These stocks are Honeywell International Inc. (NASDAQ:HON), Linde plc (NYSE:LIN), Bristol Myers Squibb Company (NYSE:BMY), Charter Communications, Inc. (NASDAQ:CHTR), Citigroup Inc. (NYSE:C), Union Pacific Corporation (NYSE:UNP), and Royal Bank of Canada (NYSE:RY). This group of stocks’ market values match UL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HON | 57 | 1834599 | 1 |

| LIN | 55 | 5920316 | 12 |

| BMY | 73 | 5202516 | -8 |

| CHTR | 75 | 19486659 | 1 |

| C | 87 | 6155245 | -3 |

| UNP | 69 | 5034926 | -6 |

| RY | 18 | 905415 | 0 |

| Average | 62 | 6362811 | -0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 62 hedge funds with bullish positions and the average amount invested in these stocks was $6363 million. That figure was $844 million in UL’s case. Citigroup Inc. (NYSE:C) is the most popular stock in this table. On the other hand Royal Bank of Canada (NYSE:RY) is the least popular one with only 18 bullish hedge fund positions. Unilever PLC (NYSE:UL) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for UL is 27.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and surpassed the market again by 1.6 percentage points. Unfortunately UL wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); UL investors were disappointed as the stock returned -7.4% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow The Unilever Group (NYSE:UL)

Follow The Unilever Group (NYSE:UL)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Weight Loss Stocks to Buy Now

- 15 Most Popular Instand Messaging Apps

- 11 Largest Aerospace Companies in America

Disclosure: None. This article was originally published at Insider Monkey.