In this article we are going to use hedge fund sentiment as a tool and determine whether Zymeworks Inc. (NYSE:ZYME) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

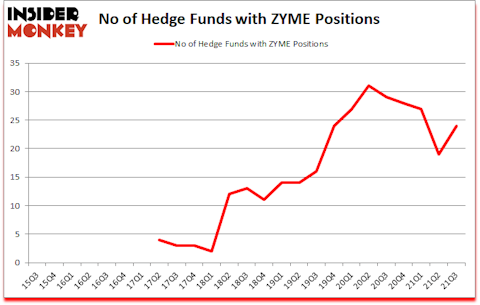

Zymeworks Inc. (NYSE:ZYME) investors should pay attention to an increase in hedge fund sentiment recently. Zymeworks Inc. (NYSE:ZYME) was in 24 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 31. There were 19 hedge funds in our database with ZYME holdings at the end of June. Our calculations also showed that ZYME isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

Felix Baker of Baker Bros.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind we’re going to take a glance at the latest hedge fund action surrounding Zymeworks Inc. (NYSE:ZYME).

Do Hedge Funds Think ZYME Is A Good Stock To Buy Now?

At the end of the third quarter, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 26% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ZYME over the last 25 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Among these funds, Perceptive Advisors held the most valuable stake in Zymeworks Inc. (NYSE:ZYME), which was worth $106.9 million at the end of the third quarter. On the second spot was Armistice Capital which amassed $73.3 million worth of shares. Baker Bros. Advisors, Lone Pine Capital, and Cormorant Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Perceptive Advisors allocated the biggest weight to Zymeworks Inc. (NYSE:ZYME), around 1.55% of its 13F portfolio. Armistice Capital is also relatively very bullish on the stock, setting aside 1.24 percent of its 13F equity portfolio to ZYME.

Now, key money managers were leading the bulls’ herd. Camber Capital Management, managed by Stephen DuBois, established the most outsized position in Zymeworks Inc. (NYSE:ZYME). Camber Capital Management had $21.8 million invested in the company at the end of the quarter. Manoj Jain and Sohit Khurana’s Maso Capital also initiated a $2.8 million position during the quarter. The other funds with new positions in the stock are Bhagwan Jay Rao’s Integral Health Asset Management, Michael Gelband’s ExodusPoint Capital, and Greg Martinez’s Parkman Healthcare Partners.

Let’s go over hedge fund activity in other stocks similar to Zymeworks Inc. (NYSE:ZYME). These stocks are The Shyft Group, Inc. (NASDAQ:SHYF), Harsco Corporation (NYSE:HSC), Gevo, Inc. (NASDAQ:GEVO), Dime Community Bancshares, Inc. (NASDAQ:DCOM), Root, Inc. (NASDAQ:ROOT), Veritiv Corp (NYSE:VRTV), and AZZ Incorporated (NYSE:AZZ). This group of stocks’ market valuations are similar to ZYME’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SHYF | 14 | 106750 | 3 |

| HSC | 11 | 44378 | 0 |

| GEVO | 7 | 28618 | -1 |

| DCOM | 13 | 190378 | 1 |

| ROOT | 16 | 110886 | -2 |

| VRTV | 11 | 354877 | -3 |

| AZZ | 12 | 62989 | -3 |

| Average | 12 | 128411 | -0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $128 million. That figure was $377 million in ZYME’s case. Root, Inc. (NASDAQ:ROOT) is the most popular stock in this table. On the other hand Gevo, Inc. (NASDAQ:GEVO) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Zymeworks Inc. (NYSE:ZYME) is more popular among hedge funds. Our overall hedge fund sentiment score for ZYME is 83.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 31.1% in 2021 through December 9th and still beat the market by 5.1 percentage points. Unfortunately ZYME wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on ZYME were disappointed as the stock returned -44.5% since the end of the third quarter (through 12/9) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Zymeworks Bc Inc. (NASDAQ:ZYME)

Follow Zymeworks Bc Inc. (NASDAQ:ZYME)

Receive real-time insider trading and news alerts

Suggested Articles:

- 21 Best Quality of Life Countries in 2021

- 10 Best Transportation Stocks To Buy Now

- 20 Fastest Growing Vacation Destinations In The US

Disclosure: None. This article was originally published at Insider Monkey.