We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of Zimmer Biomet Holdings Inc (NYSE:ZBH) based on that data.

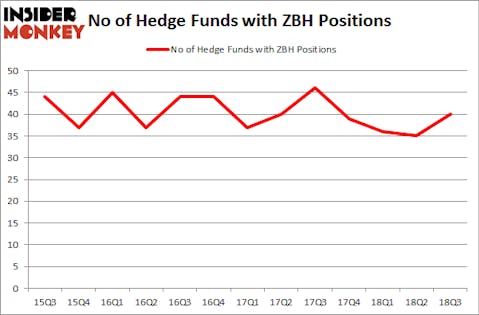

Zimmer Biomet Holdings Inc (NYSE:ZBH) was in 40 hedge funds’ portfolios at the end of the third quarter of 2018. ZBH investors should pay attention to an increase in activity from the world’s largest hedge funds in recent months. There were 35 hedge funds in our database with ZBH holdings at the end of the previous quarter. Our calculations also showed that ZBH isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action regarding Zimmer Biomet Holdings Inc (NYSE:ZBH).

How have hedgies been trading Zimmer Biomet Holdings Inc (NYSE:ZBH)?

At Q3’s end, a total of 40 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards ZBH over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, JANA Partners was the largest shareholder of Zimmer Biomet Holdings Inc (NYSE:ZBH), with a stake worth $320.9 million reported as of the end of September. Trailing JANA Partners was Healthcor Management LP, which amassed a stake valued at $279.4 million. Millennium Management, Ariel Investments, and Partner Fund Management were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, specific money managers have jumped into Zimmer Biomet Holdings Inc (NYSE:ZBH) headfirst. Point72 Asset Management, managed by Steve Cohen, established the biggest position in Zimmer Biomet Holdings Inc (NYSE:ZBH). Point72 Asset Management had $79.6 million invested in the company at the end of the quarter. Amy Mulderry’s Tavio Capital also made a $31.4 million investment in the stock during the quarter. The following funds were also among the new ZBH investors: Josh Donfeld and David Rogers’s Castle Hook Partners, Ken Griffin’s Citadel Investment Group, and Lawrence Hawkins’s Prosight Capital.

Let’s check out hedge fund activity in other stocks similar to Zimmer Biomet Holdings Inc (NYSE:ZBH). These stocks are Public Service Enterprise Group Incorporated (NYSE:PEG), Sprint Corporation (NYSE:S), T. Rowe Price Group, Inc. (NASDAQ:TROW), and McKesson Corporation (NYSE:MCK). All of these stocks’ market caps are closest to ZBH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PEG | 27 | 774639 | 9 |

| S | 20 | 433099 | 6 |

| TROW | 17 | 396447 | -8 |

| MCK | 42 | 2977552 | 2 |

| Average | 26.5 | 1145434 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.15 billion. That figure was $1.60 billion in ZBH’s case. McKesson Corporation (NYSE:MCK) is the most popular stock in this table. On the other hand T. Rowe Price Group, Inc. (NASDAQ:TROW) is the least popular one with only 17 bullish hedge fund positions. Zimmer Biomet Holdings Inc (NYSE:ZBH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MCK might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.