A market correction in the fourth quarter, spurred by a number of global macroeconomic concerns and rising interest rates ended up having a negative impact on the markets and many hedge funds as a result. The stocks of smaller companies were especially hard hit during this time as investors fled to investments seen as being safer. This is evident in the fact that the Russell 2000 ETF underperformed the S&P 500 ETF by 4 percentage points during the first half of the fourth quarter. We also received indications that hedge funds were trimming their positions amid the market volatility and uncertainty, and given their greater inclination towards smaller cap stocks than other investors, it follows that a stronger sell-off occurred in those stocks. Let’s study the hedge fund sentiment to see how those concerns affected their ownership of Webster Financial Corporation (NYSE:WBS) during the quarter.

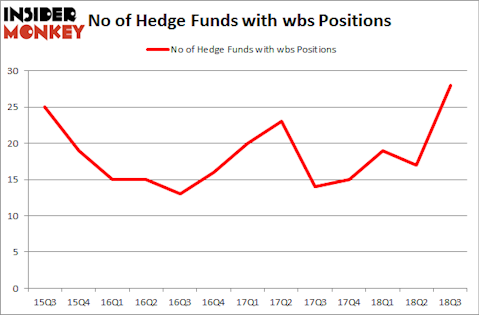

Is Webster Financial Corporation (NYSE:WBS) the right investment to pursue these days? Prominent investors are buying. The number of long hedge fund positions moved up by 11 recently. Our calculations also showed that wbs isn’t among the 30 most popular stocks among hedge funds. WBS was in 28 hedge funds’ portfolios at the end of September. There were 17 hedge funds in our database with WBS holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a glance at the new hedge fund action regarding Webster Financial Corporation (NYSE:WBS).

How are hedge funds trading Webster Financial Corporation (NYSE:WBS)?

Heading into the fourth quarter of 2018, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 65% from one quarter earlier. On the other hand, there were a total of 15 hedge funds with a bullish position in WBS at the beginning of this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

Among these funds, Pzena Investment Management held the most valuable stake in Webster Financial Corporation (NYSE:WBS), which was worth $68.7 million at the end of the third quarter. On the second spot was Polaris Capital Management which amassed $46.7 million worth of shares. Moreover, Balyasny Asset Management, Fisher Asset Management, and Nitorum Capital were also bullish on Webster Financial Corporation (NYSE:WBS), allocating a large percentage of their portfolios to this stock.

Consequently, some big names were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the most outsized position in Webster Financial Corporation (NYSE:WBS). Arrowstreet Capital had $3.6 million invested in the company at the end of the quarter. Sander Gerber’s Hudson Bay Capital Management also initiated a $3.6 million position during the quarter. The following funds were also among the new WBS investors: Matthew Tewksbury’s Stevens Capital Management, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now take a look at hedge fund activity in other stocks similar to Webster Financial Corporation (NYSE:WBS). We will take a look at CAE, Inc. (NYSE:CAE), athenahealth, Inc (NASDAQ:ATHN), Trinity Industries, Inc. (NYSE:TRN), and Mattel, Inc. (NASDAQ:MAT). This group of stocks’ market caps match WBS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAE | 10 | 90452 | 2 |

| ATHN | 27 | 335405 | 9 |

| TRN | 33 | 1280684 | 2 |

| MAT | 16 | 838039 | 2 |

| Average | 21.5 | 636145 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $636 million. That figure was $380 million in WBS’s case. Trinity Industries, Inc. (NYSE:TRN) is the most popular stock in this table. On the other hand CAE, Inc. (NYSE:CAE) is the least popular one with only 10 bullish hedge fund positions. Webster Financial Corporation (NYSE:WBS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TRN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.