At Insider Monkey we follow around 700 of the best-performing investors and even though many of them lost money in the last couple of months (70% of hedge funds lost money in October whereas S&P 500 ETF lost about 7%), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

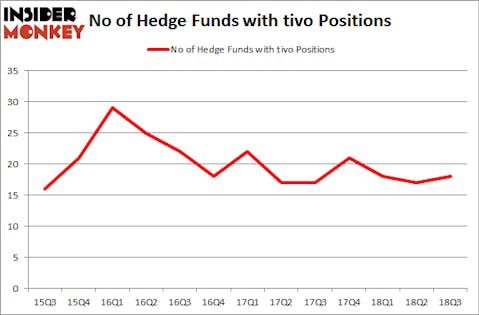

TiVo Corporation (NASDAQ:TIVO) has experienced an increase in activity from the world’s largest hedge funds in recent months. TIVO was in 18 hedge funds’ portfolios at the end of September. There were 17 hedge funds in our database with TIVO holdings at the end of the previous quarter. Our calculations also showed that tivo isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most investors, hedge funds are perceived as underperforming, old financial vehicles of the past. While there are more than 8,000 funds trading at present, Our researchers hone in on the leaders of this group, approximately 700 funds. These investment experts handle bulk of the smart money’s total asset base, and by tracking their matchless equity investments, Insider Monkey has come up with numerous investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a look at the new hedge fund action surrounding TiVo Corporation (NASDAQ:TIVO).

How are hedge funds trading TiVo Corporation (NASDAQ:TIVO)?

Heading into the fourth quarter of 2018, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from one quarter earlier. By comparison, 21 hedge funds held shares or bullish call options in TIVO heading into this year. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Engaged Capital, managed by Glenn W. Welling, holds the number one position in TiVo Corporation (NASDAQ:TIVO). Engaged Capital has a $31.4 million position in the stock, comprising 4.4% of its 13F portfolio. The second most bullish fund manager is Soros Fund Management, managed by George Soros, which holds a $20.1 million position; 0.4% of its 13F portfolio is allocated to the company. Some other professional money managers that hold long positions comprise Jamie Zimmerman’s Litespeed Management, Ken Griffin’s Citadel Investment Group and Israel Englander’s Millennium Management.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Millennium Management, managed by Israel Englander, assembled the most outsized call position in TiVo Corporation (NASDAQ:TIVO). Millennium Management had $2.5 million invested in the company at the end of the quarter. Eric Singer’s VIEX Capital Advisors also made a $1.5 million investment in the stock during the quarter. The other funds with new positions in the stock are Jay Petschek and Steven Major’s Corsair Capital Management, Sander Gerber’s Hudson Bay Capital Management, and Matthew Tewksbury’s Stevens Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as TiVo Corporation (NASDAQ:TIVO) but similarly valued. We will take a look at EnPro Industries, Inc. (NYSE:NPO), Inovalon Holdings Inc (NASDAQ:INOV), Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS), and Oclaro, Inc. (NASDAQ:OCLR). This group of stocks’ market valuations are closest to TIVO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NPO | 16 | 137214 | 6 |

| INOV | 13 | 23987 | 1 |

| KTOS | 13 | 132648 | 1 |

| OCLR | 22 | 137595 | 3 |

| Average | 16 | 107861 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $108 million. That figure was $111 million in TIVO’s case. Oclaro, Inc. (NASDAQ:OCLR) is the most popular stock in this table. On the other hand Inovalon Holdings Inc (NASDAQ:INOV) is the least popular one with only 13 bullish hedge fund positions. TiVo Corporation (NASDAQ:TIVO) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard OCLR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.