There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Signature Bank (NASDAQ:SBNY).

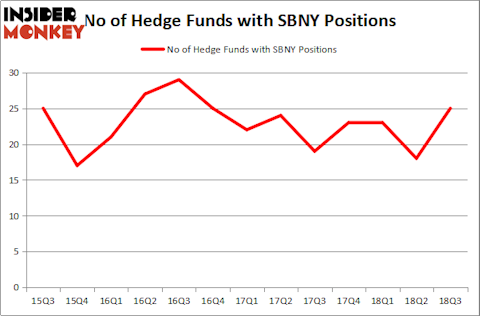

Signature Bank (NASDAQ:SBNY) investors should be aware of an increase in activity from the world’s largest hedge funds lately. Our calculations also showed that SBNY isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a gander at the latest hedge fund action encompassing Signature Bank (NASDAQ:SBNY).

What does the smart money think about Signature Bank (NASDAQ:SBNY)?

Heading into the fourth quarter of 2018, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of 39% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SBNY over the last 13 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ken Griffin’s Citadel Investment Group has the largest position in Signature Bank (NASDAQ:SBNY), worth close to $195.4 million, comprising 0.1% of its total 13F portfolio. Sitting at the No. 2 spot is Israel Englander of Millennium Management, with a $72.3 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism consist of Matthew Lindenbaum’s Basswood Capital, Jim Simons’s Renaissance Technologies and David E. Winebrenner’s Spindletop Capital.

Consequently, key money managers have jumped into Signature Bank (NASDAQ:SBNY) headfirst. North Run Capital, managed by Thomas Ellis and Todd Hammer, established the most outsized position in Signature Bank (NASDAQ:SBNY). North Run Capital had $12.4 million invested in the company at the end of the quarter. Tom Brown’s Second Curve Capital also made a $4.6 million investment in the stock during the quarter. The other funds with brand new SBNY positions are Joshua Nash’s Ulysses Management, John Overdeck and David Siegel’s Two Sigma Advisors, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Signature Bank (NASDAQ:SBNY). We will take a look at The Toro Company (NYSE:TTC), Acuity Brands, Inc. (NYSE:AYI), Gildan Activewear Inc (NYSE:GIL), and EQT GP Holdings LP (NYSE:EQGP). This group of stocks’ market values match SBNY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TTC | 21 | 498911 | -2 |

| AYI | 35 | 1284391 | 7 |

| GIL | 18 | 271699 | 3 |

| EQGP | 5 | 23037 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $520 million. That figure was $539 million in SBNY’s case. Acuity Brands, Inc. (NYSE:AYI) is the most popular stock in this table. On the other hand EQT GP Holdings LP (NYSE:EQGP) is the least popular one with only 5 bullish hedge fund positions. Signature Bank (NASDAQ:SBNY) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AYI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.