There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze General Motors Company (NYSE:GM).

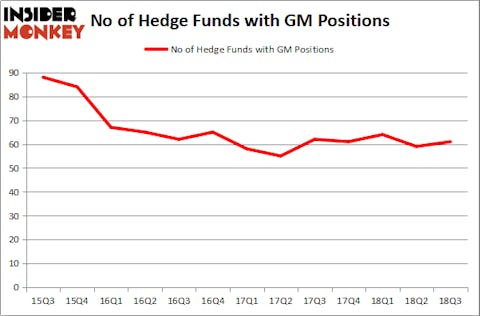

General Motors Company (NYSE:GM) investors should pay attention to an increase in activity from the world’s largest hedge funds of late. GM was in 61 hedge funds’ portfolios at the end of the third quarter of 2018. There were 59 hedge funds in our database with GM positions at the end of the previous quarter. Despite the stock garnering interest from smart money managers, the number of investors it had at the end of third quarter was far from enough for it to be counted as one of the 30 most popular stocks among hedge funds in Q3 of 2018.

General Motors recently announced it was laying off more than 14,000 people and shuttering plants in the United States and Canada. The move drew President Donald Trump’s ire, who said that he would consider pulling the plug on its subsidies as retaliation for the layoffs.

Trump promised to revive U.S. manufacturing in the runup to the 2016 presidential election and has been vocal regarding companies that shut down American operations or consider moving production overseas. The company’s shares tanked after the announcement, with many pundits expecting the stock to drop further as its battles with the President intensify.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a gander at the key hedge fund action regarding General Motors Company (NYSE:GM).

Hedge fund activity in General Motors Company (NYSE:GM)

At Q3’s end, a total of 61 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 3% from the second quarter of 2018. By comparison, 61 hedge funds held shares or bullish call options in GM heading into this year. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Warren Buffett’s Berkshire Hathaway has the largest position in General Motors Company (NYSE:GM), worth close to $1.7664 billion, corresponding to 0.8% of its total 13F portfolio. The second largest stake is held by Boykin Curry of Eagle Capital Management, with a $705.3 million position; 2.4% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors that hold long positions include Edgar Wachenheim’s Greenhaven Associates, David Einhorn’s Greenlight Capital and John A. Levin’s Levin Capital Strategies.

Consequently, key money managers have jumped into General Motors Company (NYSE:GM) headfirst. Holocene Advisors, managed by Brandon Haley, created the biggest call position in General Motors Company (NYSE:GM). Holocene Advisors had $42.9 million invested in the company at the end of the quarter. Richard S. Pzena’s Pzena Investment Management also made a $24.9 million investment in the stock during the quarter. The other funds with brand new GM positions are Steven Tananbaum’s GoldenTree Asset Management, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, and Jonathan Barrett and Paul Segal’s Luminus Management.

Let’s now review hedge fund activity in other stocks similar to General Motors Company (NYSE:GM). We will take a look at Banco Bradesco SA (NYSE:BBD), Illinois Tool Works Inc. (NYSE:ITW), American International Group Inc (NYSE:AIG), and Carnival Corporation (NYSE:CCL). This group of stocks’ market values match GM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBD | 14 | 493857 | -1 |

| ITW | 26 | 511065 | -2 |

| AIG | 41 | 1759233 | 5 |

| CCL | 36 | 981167 | 7 |

As you can see these stocks had an average of 29.25 hedge funds with bullish positions and the average amount invested in these stocks was $936 million. That figure was $4747 million in GM’s case. American International Group Inc (NYSE:AIG) is the most popular stock in this table. On the other hand Banco Bradesco SA (NYSE:BBD) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks General Motors Company (NYSE:GM) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.