The Insider Monkey team has completed processing the quarterly 13F filings for the March quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Enerplus Corp (NYSE:ERF).

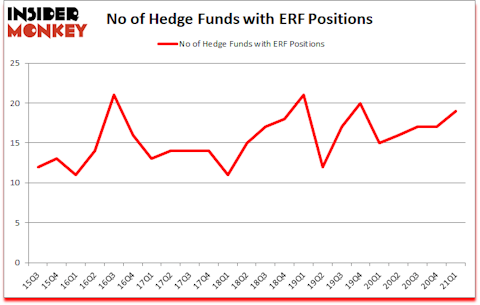

Is Enerplus Corp (NYSE:ERF) undervalued? Prominent investors were taking a bullish view. The number of bullish hedge fund positions inched up by 2 lately. Enerplus Corp (NYSE:ERF) was in 19 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 21. Our calculations also showed that ERF isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings). There were 17 hedge funds in our database with ERF positions at the end of the fourth quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 115 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

Paul Marshall of Marshall Wace

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, Chuck Schumer recently stated that marijuana legalization will be a Senate priority. So, we are checking out this under the radar stock that will benefit from this. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now we’re going to take a look at the recent hedge fund action encompassing Enerplus Corp (NYSE:ERF).

Do Hedge Funds Think ERF Is A Good Stock To Buy Now?

At Q1’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 12% from the previous quarter. By comparison, 15 hedge funds held shares or bullish call options in ERF a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Encompass Capital Advisors, managed by Todd J. Kantor, holds the biggest position in Enerplus Corp (NYSE:ERF). Encompass Capital Advisors has a $77.3 million position in the stock, comprising 6% of its 13F portfolio. The second most bullish fund manager is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $25.7 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other peers that are bullish comprise John Overdeck and David Siegel’s Two Sigma Advisors, D. E. Shaw’s D E Shaw and Noam Gottesman’s GLG Partners. In terms of the portfolio weights assigned to each position Encompass Capital Advisors allocated the biggest weight to Enerplus Corp (NYSE:ERF), around 6.05% of its 13F portfolio. GRT Capital Partners is also relatively very bullish on the stock, designating 0.06 percent of its 13F equity portfolio to ERF.

As aggregate interest increased, some big names were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, established the most outsized position in Enerplus Corp (NYSE:ERF). Marshall Wace LLP had $0.3 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also initiated a $0.2 million position during the quarter. The only other fund with a brand new ERF position is Ray Dalio’s Bridgewater Associates.

Let’s also examine hedge fund activity in other stocks similar to Enerplus Corp (NYSE:ERF). These stocks are Dynavax Technologies Corporation (NASDAQ:DVAX), SecureWorks Corp. (NASDAQ:SCWX), Brookdale Senior Living, Inc. (NYSE:BKD), Avid Bioservices, Inc. (NASDAQ:CDMO), NOW Inc (NYSE:DNOW), Community Healthcare Trust Inc (NYSE:CHCT), and Brooge Energy Limited (NASDAQ:BROG). This group of stocks’ market values match ERF’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DVAX | 14 | 81307 | 0 |

| SCWX | 12 | 20191 | 1 |

| BKD | 23 | 386290 | 4 |

| CDMO | 21 | 140924 | -4 |

| DNOW | 18 | 117523 | -4 |

| CHCT | 14 | 81537 | 2 |

| BROG | 6 | 40875 | 0 |

| Average | 15.4 | 124092 | -0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.4 hedge funds with bullish positions and the average amount invested in these stocks was $124 million. That figure was $145 million in ERF’s case. Brookdale Senior Living, Inc. (NYSE:BKD) is the most popular stock in this table. On the other hand Brooge Energy Limited (NASDAQ:BROG) is the least popular one with only 6 bullish hedge fund positions. Enerplus Corp (NYSE:ERF) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for ERF is 72.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 23.8% in 2021 through July 16th and still beat the market by 7.7 percentage points. Hedge funds were also right about betting on ERF as the stock returned 22.5% since the end of Q1 (through 7/16) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Enerplus Resources Fund (NYSE:ERF)

Follow Enerplus Resources Fund (NYSE:ERF)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Biggest Cosmetic Companies In The World

- 10 Best Transportation Stocks To Buy Now

- 10 Most Profitable Industries in the US

Disclosure: None. This article was originally published at Insider Monkey.