Before we spend many hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Energizer Holdings, Inc. (NYSE:ENR).

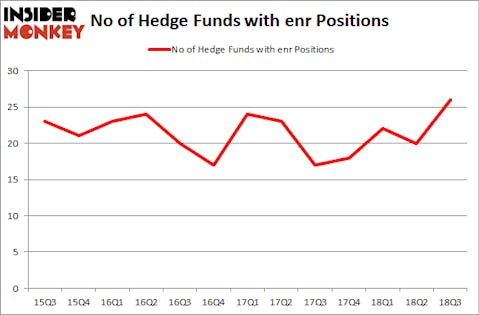

Energizer Holdings, Inc. (NYSE:ENR) was in 26 hedge funds’ portfolios at the end of the third quarter of 2018. ENR has experienced an increase in activity from the world’s largest hedge funds in recent months. There were 20 hedge funds in our database with ENR holdings at the end of the previous quarter. Our calculations also showed that enr isn’t among the 30 most popular stocks among hedge funds.

At the moment there are dozens of tools shareholders put to use to value stocks. A pair of the most innovative tools are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the elite money managers can outpace the market by a solid margin (see the details here).

We’re going to review the key hedge fund action encompassing Energizer Holdings, Inc. (NYSE:ENR).

How have hedgies been trading Energizer Holdings, Inc. (NYSE:ENR)?

Heading into the fourth quarter of 2018, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 30% from the previous quarter. On the other hand, there were a total of 18 hedge funds with a bullish position in ENR at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Mario Gabelli’s GAMCO Investors has the number one position in Energizer Holdings, Inc. (NYSE:ENR), worth close to $79.8 million, amounting to 0.5% of its total 13F portfolio. The second largest stake is held by Alexander Mitchell of Scopus Asset Management, with a $52.3 million position; the fund has 0.7% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions contain Jim Simons’s Renaissance Technologies, Frederick DiSanto’s Ancora Advisors and D. E. Shaw’s D E Shaw.

As one would reasonably expect, some big names have been driving this bullishness. D E Shaw, managed by D. E. Shaw, assembled the biggest position in Energizer Holdings, Inc. (NYSE:ENR). D E Shaw had $11 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $3.7 million position during the quarter. The other funds with new positions in the stock are Ward Davis and Brian Agnew’s Caerus Global Investors, Matthew Tewksbury’s Stevens Capital Management, and Benjamin A. Smith’s Laurion Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Energizer Holdings, Inc. (NYSE:ENR) but similarly valued. These stocks are Generac Holdings Inc. (NYSE:GNRC), PolyOne Corporation (NYSE:POL), CNO Financial Group Inc (NYSE:CNO), and Crescent Point Energy Corp (NYSE:CPG). This group of stocks’ market values are similar to ENR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GNRC | 24 | 167244 | 7 |

| POL | 15 | 58503 | 0 |

| CNO | 14 | 143832 | -3 |

| CPG | 12 | 61886 | 0 |

| Average | 16.25 | 107866 | 1 |

View table here

if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $108 million. That figure was $272 million in ENR’s case. Generac Holdings Inc. (NYSE:GNRC) is the most popular stock in this table. On the other hand Crescent Point Energy Corp (NYSE:CPG) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Energizer Holdings, Inc. (NYSE:ENR) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.