At Insider Monkey we follow around 700 of the best-performing investors and even though many of them lost money in the last couple of months (70% of hedge funds lost money in October whereas S&P 500 ETF lost about 7%), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

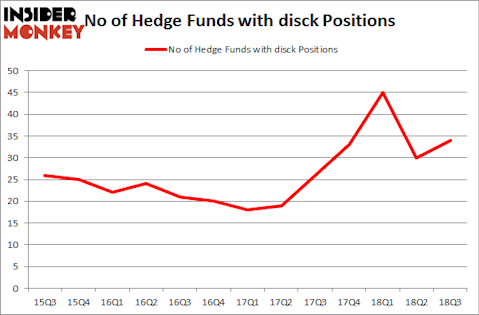

Discovery, Inc. (NASDAQ:DISCK) investors should pay attention to an increase in enthusiasm from smart money of late. DISCK was in 34 hedge funds’ portfolios at the end of the third quarter of 2018. There were 30 hedge funds in our database with DISCK positions at the end of the previous quarter. Our calculations also showed that disck isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the fresh hedge fund action regarding Discovery, Inc. (NASDAQ:DISCK).

What does the smart money think about Discovery, Inc. (NASDAQ:DISCK)?

At the end of the third quarter, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in DISCK over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Paulson & Co was the largest shareholder of Discovery, Inc. (NASDAQ:DISCK), with a stake worth $361.8 million reported as of the end of September. Trailing Paulson & Co was Chieftain Capital, which amassed a stake valued at $263 million. Citadel Investment Group, CQS Cayman LP, and Carlson Capital were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, some big names have jumped into Discovery, Inc. (NASDAQ:DISCK) headfirst. Hudson Bay Capital Management, managed by Sander Gerber, created the most outsized position in Discovery, Inc. (NASDAQ:DISCK). Hudson Bay Capital Management had $31.9 million invested in the company at the end of the quarter. Bijan Modanlou, Joseph Bou-Saba, and Jayaveera Kodali’s Alta Park Capital also initiated a $8.4 million position during the quarter. The following funds were also among the new DISCK investors: Jonathan Kolatch’s Redwood Capital Management and Glenn Russell Dubin’s Highbridge Capital Management.

Let’s now review hedge fund activity in other stocks similar to Discovery, Inc. (NASDAQ:DISCK). These stocks are Magellan Midstream Partners, L.P. (NYSE:MMP), Ameren Corporation (NYSE:AEE), Celanese Corporation (NYSE:CE), and Mercadolibre Inc (NASDAQ:MELI). This group of stocks’ market caps resemble DISCK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MMP | 14 | 73929 | 0 |

| AEE | 21 | 684395 | 5 |

| CE | 32 | 1332134 | -1 |

| MELI | 27 | 1977651 | -2 |

| Average | 23.5 | 1017027 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.02 billion. That figure was $1.26 billion in DISCK’s case. Celanese Corporation (NYSE:CE) is the most popular stock in this table. On the other hand Magellan Midstream Partners, L.P. (NYSE:MMP) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Discovery, Inc. (NASDAQ:DISCK) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.