Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost a third of its value since the end of July. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 S&P 500 stocks among hedge funds at the end of September 2018 yielded an average return of 6.7% year-to-date, vs. a gain of 2.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of B2Gold Corp (NYSEMKT:BTG).

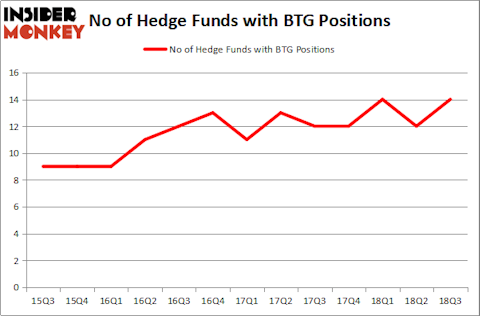

B2Gold Corp (NYSEMKT:BTG) shareholders have witnessed an increase in enthusiasm from smart money lately. BTG was in 14 hedge funds’ portfolios at the end of the third quarter of 2018. There were 12 hedge funds in our database with BTG positions at the end of the previous quarter. Our calculations also showed that BTG isn’t among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are assumed to be underperforming, outdated investment tools of yesteryear. While there are greater than 8,000 funds in operation at the moment, Our experts look at the masters of this group, approximately 700 funds. These investment experts handle the lion’s share of the smart money’s total asset base, and by monitoring their best equity investments, Insider Monkey has uncovered numerous investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s check out the latest hedge fund action encompassing B2Gold Corp (NYSEMKT:BTG).

How have hedgies been trading B2Gold Corp (NYSEMKT:BTG)?

Heading into the fourth quarter of 2018, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BTG over the last 13 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in B2Gold Corp (NYSEMKT:BTG), which was worth $24.6 million at the end of the third quarter. On the second spot was Impala Asset Management which amassed $22.8 million worth of shares. Moreover, Sprott Asset Management, Prince Street Capital Management, and Citadel Investment Group were also bullish on B2Gold Corp (NYSEMKT:BTG), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Prince Street Capital Management, managed by David Halpert, assembled the most outsized position in B2Gold Corp (NYSEMKT:BTG). Prince Street Capital Management had $3.6 million invested in the company at the end of the quarter. George Zweig, Shane Haas and Ravi Chander’s Signition LP also made a $0.5 million investment in the stock during the quarter. The only other fund with a new position in the stock is Dmitry Balyasny’s Balyasny Asset Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as B2Gold Corp (NYSEMKT:BTG) but similarly valued. We will take a look at Cambrex Corporation (NYSE:CBM), Compass Minerals International, Inc. (NYSE:CMP), Dominion Energy Midstream Partners, LP (NYSE:DM), and ExlService Holdings, Inc. (NASDAQ:EXLS). This group of stocks’ market valuations resemble BTG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBM | 17 | 46892 | 2 |

| CMP | 11 | 117405 | -1 |

| DM | 4 | 12285 | 3 |

| EXLS | 10 | 58943 | -1 |

| Average | 10.5 | 58881 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $59 million. That figure was $65 million in BTG’s case. Cambrex Corporation (NYSE:CBM) is the most popular stock in this table. On the other hand Dominion Energy Midstream Partners, LP (NYSE:DM) is the least popular one with only 4 bullish hedge fund positions. B2Gold Corp (NYSEMKT:BTG) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CBM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.