We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Arrow Electronics, Inc. (NYSE:ARW).

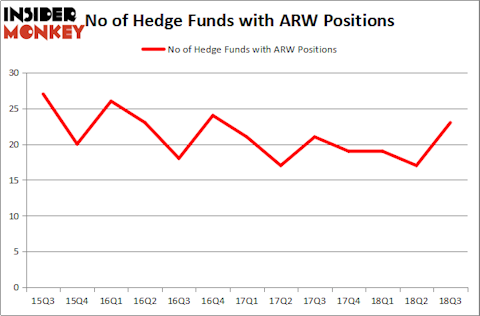

Arrow Electronics, Inc. (NYSE:ARW) was in 23 hedge funds’ portfolios at the end of September. ARW investors should be aware of an increase in activity from the world’s largest hedge funds recently. There were 17 hedge funds in our database with ARW positions at the end of the previous quarter. Our calculations also showed that ARW isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most investors, hedge funds are viewed as slow, old financial vehicles of years past. While there are greater than 8,000 funds with their doors open today, We choose to focus on the moguls of this group, about 700 funds. These money managers direct the majority of all hedge funds’ total asset base, and by paying attention to their finest stock picks, Insider Monkey has revealed numerous investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a glance at the new hedge fund action regarding Arrow Electronics, Inc. (NYSE:ARW).

Hedge fund activity in Arrow Electronics, Inc. (NYSE:ARW)

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of 35% from one quarter earlier. By comparison, 19 hedge funds held shares or bullish call options in ARW heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Arrow Electronics, Inc. (NYSE:ARW) was held by AQR Capital Management, which reported holding $192.2 million worth of stock at the end of September. It was followed by Alyeska Investment Group with a $87.1 million position. Other investors bullish on the company included GMT Capital, Citadel Investment Group, and Adage Capital Management.

Consequently, key money managers were leading the bulls’ herd. Carlson Capital, managed by Clint Carlson, assembled the largest position in Arrow Electronics, Inc. (NYSE:ARW). Carlson Capital had $17.4 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also made a $3 million investment in the stock during the quarter. The other funds with brand new ARW positions are Matthew Tewksbury’s Stevens Capital Management, Alec Litowitz and Ross Laser’s Magnetar Capital, and Noam Gottesman’s GLG Partners.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Arrow Electronics, Inc. (NYSE:ARW) but similarly valued. These stocks are Transocean Ltd (NYSE:RIG), Douglas Emmett, Inc. (NYSE:DEI), National Instruments Corporation (NASDAQ:NATI), and Berry Global Group Inc (NYSE:BERY). This group of stocks’ market values resemble ARW’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RIG | 42 | 861336 | 9 |

| DEI | 14 | 345417 | 3 |

| NATI | 24 | 500731 | 4 |

| BERY | 36 | 1964835 | 3 |

| Average | 29 | 918080 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $918 million. That figure was $509 million in ARW’s case. Transocean Ltd (NYSE:RIG) is the most popular stock in this table. On the other hand Douglas Emmett, Inc. (NYSE:DEI) is the least popular one with only 14 bullish hedge fund positions. Arrow Electronics, Inc. (NYSE:ARW) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RIG might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.