How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Altice USA, Inc. (NYSE:ATUS).

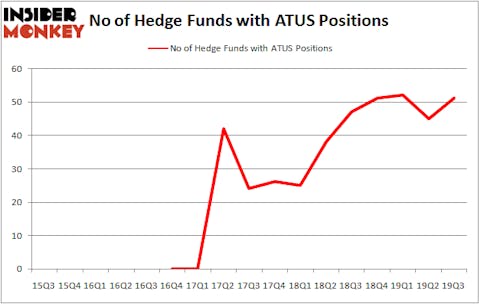

Is Altice USA, Inc. (NYSE:ATUS) ready to rally soon? The best stock pickers are turning bullish. The number of bullish hedge fund positions rose by 6 lately. Our calculations also showed that ATUS isn’t among the 30 most popular stocks among hedge funds (see the video below). ATUS was in 51 hedge funds’ portfolios at the end of the third quarter of 2019. There were 45 hedge funds in our database with ATUS holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are many gauges stock market investors employ to assess publicly traded companies. A couple of the most under-the-radar gauges are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the best investment managers can trounce the S&P 500 by a superb margin (see the details here).

Charles Davidson of Wexford Capital

Let’s take a look at the new hedge fund action encompassing Altice USA, Inc. (NYSE:ATUS).

What does smart money think about Altice USA, Inc. (NYSE:ATUS)?

At Q3’s end, a total of 51 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ATUS over the last 17 quarters. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

More specifically, Soroban Capital Partners was the largest shareholder of Altice USA, Inc. (NYSE:ATUS), with a stake worth $602.3 million reported as of the end of September. Trailing Soroban Capital Partners was Citadel Investment Group, which amassed a stake valued at $318.7 million. Renaissance Technologies, Pelham Capital, and Zimmer Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Pelham Capital allocated the biggest weight to Altice USA, Inc. (NYSE:ATUS), around 25.21% of its portfolio. Simcoe Capital Management is also relatively very bullish on the stock, setting aside 18.15 percent of its 13F equity portfolio to ATUS.

Consequently, some big names were breaking ground themselves. Thames Capital Management, managed by Jay Genzer, created the most valuable position in Altice USA, Inc. (NYSE:ATUS). Thames Capital Management had $8.2 million invested in the company at the end of the quarter. Principal Global Investors’s Columbus Circle Investors also initiated a $7.5 million position during the quarter. The following funds were also among the new ATUS investors: Charles Davidson and Joseph Jacobs’s Wexford Capital, Daniel S. Och (founder)’s Sculptor Capital, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s check out hedge fund activity in other stocks similar to Altice USA, Inc. (NYSE:ATUS). These stocks are Cadence Design Systems Inc (NASDAQ:CDNS), Fortis Inc. (NYSE:FTS), MSCI Inc (NYSE:MSCI), and Hess Corporation (NYSE:HES). This group of stocks’ market caps match ATUS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CDNS | 33 | 1579724 | 5 |

| FTS | 13 | 561241 | 1 |

| MSCI | 37 | 643687 | 1 |

| HES | 36 | 921996 | 1 |

| Average | 29.75 | 926662 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.75 hedge funds with bullish positions and the average amount invested in these stocks was $927 million. That figure was $3138 million in ATUS’s case. MSCI Inc (NYSE:MSCI) is the most popular stock in this table. On the other hand Fortis Inc. (NYSE:FTS) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Altice USA, Inc. (NYSE:ATUS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately ATUS wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ATUS were disappointed as the stock returned -9.1% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.