Out of thousands of stocks that are currently traded on the market, it is difficult to determine those that can really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of over 700 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Xperi Corporation (NASDAQ:XPER).

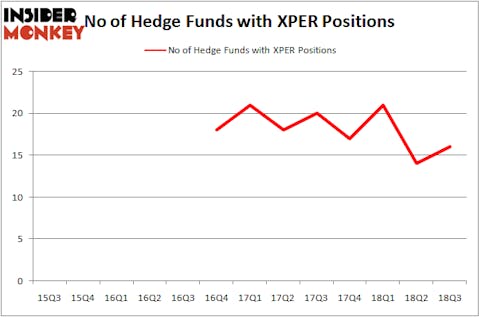

Is Xperi Corporation (NASDAQ:XPER) an excellent investment right now? The best stock pickers are turning bullish. The number of bullish hedge fund positions rose by 2 recently. Our calculations also showed that XPER isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the recent hedge fund action encompassing Xperi Corporation (NASDAQ:XPER).

What have hedge funds been doing with Xperi Corporation (NASDAQ:XPER)?

At Q3’s end, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 14% from the previous quarter. By comparison, 17 hedge funds held shares or bullish call options in XPER heading into this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

The largest stake in Xperi Corporation (NASDAQ:XPER) was held by Nokomis Capital, which reported holding $18 million worth of stock at the end of September. It was followed by D E Shaw with a $15.1 million position. Other investors bullish on the company included Trigran Investments, Carlson Capital, and Renaissance Technologies.

As industrywide interest jumped, key money managers were breaking ground themselves. Harvey Partners, managed by Jeffrey Moskowitz, assembled the most valuable position in Xperi Corporation (NASDAQ:XPER). Harvey Partners had $4.1 million invested in the company at the end of the quarter. David Brown’s Hawk Ridge Management also initiated a $2.1 million position during the quarter. The other funds with new positions in the stock are Mike Vranos’s Ellington and Ken Griffin’s Citadel Investment Group.

Let’s now take a look at hedge fund activity in other stocks similar to Xperi Corporation (NASDAQ:XPER). We will take a look at Schnitzer Steel Industries, Inc. (NASDAQ:SCHN), RadNet Inc. (NASDAQ:RDNT), Sierra Wireless, Inc. (NASDAQ:SWIR), and Cohu, Inc. (NASDAQ:COHU). This group of stocks’ market caps are similar to XPER’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SCHN | 19 | 57579 | 1 |

| RDNT | 11 | 99896 | 0 |

| SWIR | 8 | 34353 | 1 |

| COHU | 15 | 83976 | 5 |

| Average | 13.25 | 68951 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $69 million. That figure was $86 million in XPER’s case. Schnitzer Steel Industries, Inc. (NASDAQ:SCHN) is the most popular stock in this table. On the other hand Sierra Wireless, Inc. (NASDAQ:SWIR) is the least popular one with only 8 bullish hedge fund positions. Xperi Corporation (NASDAQ:XPER) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SCHN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.