At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Is Trinseo S.A. (NYSE:TSE) a good stock to buy now? Prominent investors are taking a bullish view. The number of long hedge fund positions inched up by 1 recently. Our calculations also showed that tse isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a large number of indicators investors have at their disposal to analyze publicly traded companies. A pair of the most underrated indicators are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the top hedge fund managers can outclass the market by a significant amount (see the details here).

We’re going to take a gander at the key hedge fund action encompassing Trinseo S.A. (NYSE:TSE).

Hedge fund activity in Trinseo S.A. (NYSE:TSE)

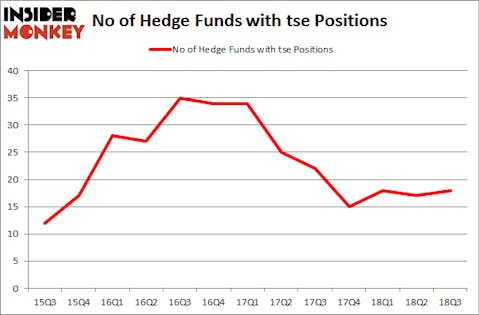

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards TSE over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Trinseo S.A. (NYSE:TSE), with a stake worth $110.7 million reported as of the end of September. Trailing Renaissance Technologies was AQR Capital Management, which amassed a stake valued at $23.6 million. GLG Partners, Millennium Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key hedge funds were leading the bulls’ herd. HBK Investments, managed by David Costen Haley, assembled the most outsized position in Trinseo S.A. (NYSE:TSE). HBK Investments had $2.7 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $1.5 million position during the quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Trinseo S.A. (NYSE:TSE) but similarly valued. We will take a look at Cornerstone OnDemand, Inc. (NASDAQ:CSOD), McDermott International, Inc. (NYSE:MDR), Nuveen AMT-Free Quality Municipal Income Fund (NYSE:NEA), and RPC, Inc. (NYSE:RES). This group of stocks’ market caps match TSE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CSOD | 28 | 784531 | 7 |

| MDR | 24 | 322643 | 2 |

| NEA | 3 | 7428 | -1 |

| RES | 15 | 153824 | -4 |

| Average | 17.5 | 317107 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $317 million. That figure was $209 million in TSE’s case. Cornerstone OnDemand, Inc. (NASDAQ:CSOD) is the most popular stock in this table. On the other hand Nuveen AMT-Free Quality Municipal Income Fund (NYSE:NEA) is the least popular one with only 3 bullish hedge fund positions. Trinseo S.A. (NYSE:TSE) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CSOD might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.