Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 900 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Sea Limited (NYSE:SE) in this article.

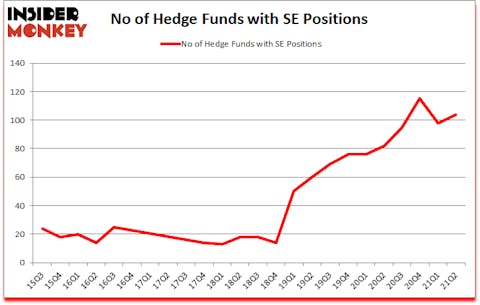

Sea Limited (NYSE:SE) shareholders have witnessed an increase in support from the world’s most elite money managers in recent months. Sea Limited (NYSE:SE) was in 104 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 115. There were 98 hedge funds in our database with SE holdings at the end of March. Our calculations also showed that SE ranked 18th among the 30 most popular stocks among hedge funds (click for Q2 rankings).

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). We have been able to outperform the passive index funds by tracking the moves of corporate insiders and hedge funds, and we believe small investors can benefit a lot from reading hedge fund investor letters and 13F filings.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to check out the new hedge fund action regarding Sea Limited (NYSE:SE).

Do Hedge Funds Think SE Is A Good Stock To Buy Now?

At the end of June, a total of 104 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from one quarter earlier. By comparison, 82 hedge funds held shares or bullish call options in SE a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Sea Limited (NYSE:SE) was held by Tiger Global Management LLC, which reported holding $2786.8 million worth of stock at the end of June. It was followed by Kora Management with a $956.7 million position. Other investors bullish on the company included ARK Investment Management, Coatue Management, and SCGE Management. In terms of the portfolio weights assigned to each position Kora Management allocated the biggest weight to Sea Limited (NYSE:SE), around 94.54% of its 13F portfolio. ShawSpring Partners is also relatively very bullish on the stock, earmarking 33.07 percent of its 13F equity portfolio to SE.

As one would reasonably expect, key hedge funds have been driving this bullishness. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, assembled the largest position in Sea Limited (NYSE:SE). LMR Partners had $209.5 million invested in the company at the end of the quarter. Gabriel Plotkin’s Melvin Capital Management also initiated a $151 million position during the quarter. The following funds were also among the new SE investors: James Dinan’s York Capital Management, Nancy Zevenbergen’s Zevenbergen Capital Investments, and Lee Ainslie’s Maverick Capital.

Let’s check out hedge fund activity in other stocks similar to Sea Limited (NYSE:SE). These stocks are NextEra Energy, Inc. (NYSE:NEE), Anheuser-Busch InBev SA/NV (NYSE:BUD), The Boeing Company (NYSE:BA), Amgen, Inc. (NASDAQ:AMGN), The Charles Schwab Corporation (NYSE:SCHW), Lowe’s Companies, Inc. (NYSE:LOW), and Rio Tinto Group (NYSE:RIO). This group of stocks’ market values resemble SE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEE | 59 | 2686533 | -4 |

| BUD | 18 | 1234449 | 0 |

| BA | 59 | 1368946 | 0 |

| AMGN | 53 | 1651799 | 6 |

| SCHW | 72 | 4851670 | -4 |

| LOW | 63 | 4968014 | 2 |

| RIO | 21 | 1420451 | -4 |

| Average | 49.3 | 2597409 | -0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 49.3 hedge funds with bullish positions and the average amount invested in these stocks was $2597 million. That figure was $12210 million in SE’s case. The Charles Schwab Corporation (NYSE:SCHW) is the most popular stock in this table. On the other hand Anheuser-Busch InBev SA/NV (NYSE:BUD) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Sea Limited (NYSE:SE) is more popular among hedge funds. Our overall hedge fund sentiment score for SE is 88.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 24.1% in 2021 through September 20th but still managed to beat the market by 6.9 percentage points. Hedge funds were also right about betting on SE as the stock returned 20% since the end of June (through 9/20) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Sea Ltd (NYSE:SE)

Follow Sea Ltd (NYSE:SE)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Most Annoying Email Newsletters to Sign Horrible People Up to

- Top 10 Large-Cap Healthcare Stocks to Buy Now

- 15 Richest People in Central and South America

Disclosure: None. This article was originally published at Insider Monkey.