Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

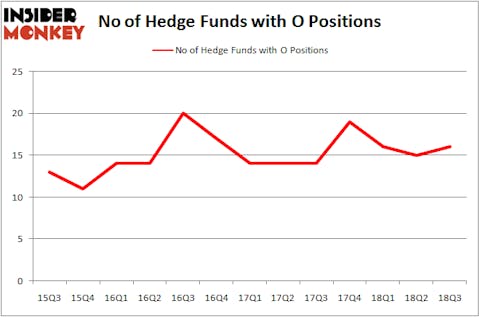

Is Realty Income Corporation (NYSE:O) a buy right now? The smart money is getting more optimistic. The number of long hedge fund bets advanced by 1 lately. Our calculations also showed that O isn’t among the 30 most popular stocks among hedge funds. O was in 16 hedge funds’ portfolios at the end of September. There were 15 hedge funds in our database with O holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the latest hedge fund action encompassing Realty Income Corporation (NYSE:O).

What does the smart money think about Realty Income Corporation (NYSE:O)?

Heading into the fourth quarter of 2018, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from one quarter earlier. By comparison, 19 hedge funds held shares or bullish call options in O heading into this year. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Zimmer Partners, managed by Stuart J. Zimmer, holds the biggest position in Realty Income Corporation (NYSE:O). Zimmer Partners has a $76.1 million position in the stock, comprising 1% of its 13F portfolio. Sitting at the No. 2 spot is Balyasny Asset Management, led by Dmitry Balyasny, holding a $39.1 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other peers with similar optimism contain Phill Gross and Robert Atchinson’s Adage Capital Management, Jim Simons’s Renaissance Technologies and Matthew Hulsizer’s PEAK6 Capital Management.

Consequently, key hedge funds have been driving this bullishness. Zimmer Partners, managed by Stuart J. Zimmer, created the most valuable position in Realty Income Corporation (NYSE:O). Zimmer Partners had $76.1 million invested in the company at the end of the quarter. Richard Driehaus’s Driehaus Capital also made a $1.4 million investment in the stock during the quarter. The other funds with brand new O positions are Joel Greenblatt’s Gotham Asset Management, Jeffrey Pierce’s Snow Park Capital Partners, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Realty Income Corporation (NYSE:O) but similarly valued. We will take a look at Huntington Bancshares Incorporated (NASDAQ:HBAN), National Oilwell Varco, Inc. (NYSE:NOV), ResMed Inc. (NYSE:RMD), and Telefonica Brasil SA (NYSE:VIV). This group of stocks’ market valuations are similar to O’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HBAN | 26 | 261222 | 0 |

| NOV | 22 | 639635 | 8 |

| RMD | 24 | 488694 | 5 |

| VIV | 13 | 86839 | 4 |

| Average | 21.25 | 369098 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $369 million. That figure was $178 million in O’s case. Huntington Bancshares Incorporated (NASDAQ:HBAN) is the most popular stock in this table. On the other hand Telefonica Brasil SA (NYSE:VIV) is the least popular one with only 13 bullish hedge fund positions. Realty Income Corporation (NYSE:O) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HBAN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.