The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 873 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their June 30th holdings, data that is available nowhere else. Should you consider Plymouth Industrial REIT, Inc. (NYSE:PLYM) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

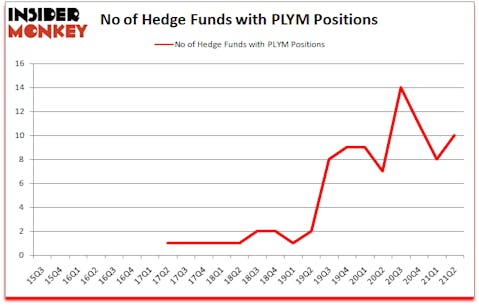

Is Plymouth Industrial REIT, Inc. (NYSE:PLYM) worth your attention right now? Money managers were buying. The number of bullish hedge fund positions moved up by 2 lately. Plymouth Industrial REIT, Inc. (NYSE:PLYM) was in 10 hedge funds’ portfolios at the end of June. The all time high for this statistic is 14. Our calculations also showed that PLYM isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

To most market participants, hedge funds are viewed as underperforming, old financial vehicles of the past. While there are more than 8000 funds trading at present, Our experts look at the leaders of this club, around 850 funds. These investment experts orchestrate most of all hedge funds’ total asset base, and by keeping an eye on their highest performing stock picks, Insider Monkey has unearthed various investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website .

David Siegel of Two Sigma Advisors

Now let’s take a gander at the latest hedge fund action regarding Plymouth Industrial REIT, Inc. (NYSE:PLYM).

Do Hedge Funds Think PLYM Is A Good Stock To Buy Now?

At second quarter’s end, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 25% from the first quarter of 2020. Below, you can check out the change in hedge fund sentiment towards PLYM over the last 24 quarters. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

The largest stake in Plymouth Industrial REIT, Inc. (NYSE:PLYM) was held by Highland Capital Management, which reported holding $11.7 million worth of stock at the end of June. It was followed by Gillson Capital with a $7.4 million position. Other investors bullish on the company included LDR Capital, Two Sigma Advisors, and Renaissance Technologies. In terms of the portfolio weights assigned to each position LDR Capital allocated the biggest weight to Plymouth Industrial REIT, Inc. (NYSE:PLYM), around 3.73% of its 13F portfolio. Highland Capital Management is also relatively very bullish on the stock, designating 2.56 percent of its 13F equity portfolio to PLYM.

As aggregate interest increased, key hedge funds have been driving this bullishness. Highland Capital Management, managed by James Dondero, created the biggest position in Plymouth Industrial REIT, Inc. (NYSE:PLYM). Highland Capital Management had $11.7 million invested in the company at the end of the quarter. Noam Gottesman’s GLG Partners also made a $0.4 million investment in the stock during the quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Plymouth Industrial REIT, Inc. (NYSE:PLYM). These stocks are One Liberty Properties, Inc. (NYSE:OLP), Sabine Royalty Trust (NYSE:SBR), Midland States Bancorp, Inc. (NASDAQ:MSBI), Cass Information Systems, Inc. (NASDAQ:CASS), Hoegh LNG Partners LP (NYSE:HMLP), KalVista Pharmaceuticals, Inc. (NASDAQ:KALV), and Hanmi Financial Corp (NASDAQ:HAFC). This group of stocks’ market values are similar to PLYM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OLP | 4 | 33147 | -4 |

| SBR | 5 | 17683 | 0 |

| MSBI | 7 | 7862 | 0 |

| CASS | 14 | 32463 | 5 |

| HMLP | 5 | 17927 | -2 |

| KALV | 19 | 235380 | -4 |

| HAFC | 11 | 22536 | -2 |

| Average | 9.3 | 52428 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.3 hedge funds with bullish positions and the average amount invested in these stocks was $52 million. That figure was $43 million in PLYM’s case. KalVista Pharmaceuticals, Inc. (NASDAQ:KALV) is the most popular stock in this table. On the other hand One Liberty Properties, Inc. (NYSE:OLP) is the least popular one with only 4 bullish hedge fund positions. Plymouth Industrial REIT, Inc. (NYSE:PLYM) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for PLYM is 48.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 25.7% in 2021 through September 27th and still beat the market by 6.2 percentage points. Hedge funds were also right about betting on PLYM as the stock returned 13.2% since the end of Q2 (through 9/27) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Plymouth Industrial Reit Inc. (NYSE:PLYM)

Follow Plymouth Industrial Reit Inc. (NYSE:PLYM)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Asian Stocks to Buy Now

- 10 Best Cryptocurrencies to Invest in According to Hedge Fund Billionaires

- 25 Countries with the Most Debt Per Capita and Debt to GDP: 2020 Rankings

Disclosure: None. This article was originally published at Insider Monkey.