Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 30 stock picks easily bested the broader market, at 6.7% compared to 2.6%, despite there being a few duds in there like Facebook (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

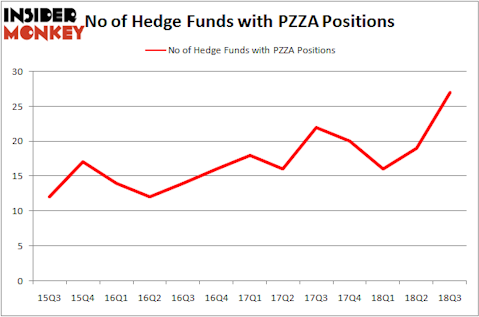

Is Papa John’s International, Inc. (NASDAQ:PZZA) a buy, sell, or hold? The smart money is buying. The number of long hedge fund positions inched up by 8 in recent months. Our calculations also showed that PZZA isn’t among the 30 most popular stocks among hedge funds. PZZA was in 27 hedge funds’ portfolios at the end of the third quarter of 2018. There were 19 hedge funds in our database with PZZA positions at the end of the previous quarter.

If you’d ask most stock holders, hedge funds are seen as underperforming, old financial vehicles of the past. While there are more than 8,000 funds in operation at the moment, Our experts hone in on the crème de la crème of this club, about 700 funds. These money managers manage the lion’s share of the smart money’s total asset base, and by observing their inimitable equity investments, Insider Monkey has uncovered a number of investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a look at the recent hedge fund action regarding Papa John’s International, Inc. (NASDAQ:PZZA).

What have hedge funds been doing with Papa John’s International, Inc. (NASDAQ:PZZA)?

At Q3’s end, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a change of 42% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards PZZA over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

More specifically, Legion Partners Asset Management was the largest shareholder of Papa John’s International, Inc. (NASDAQ:PZZA), with a stake worth $88.5 million reported as of the end of September. Trailing Legion Partners Asset Management was Bares Capital Management, which amassed a stake valued at $85.5 million. Black-and-White Capital, Citadel Investment Group, and Chilton Investment Company were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Legion Partners Asset Management, managed by Ted White and Christopher Kiper, created the biggest position in Papa John’s International, Inc. (NASDAQ:PZZA). Legion Partners Asset Management had $88.5 million invested in the company at the end of the quarter. Seth Wunder’s Black-and-White Capital also initiated a $69.2 million position during the quarter. The following funds were also among the new PZZA investors: Alexander Mitchell’s Scopus Asset Management, Jamie Zimmerman’s Litespeed Management, and Ward Davis and Brian Agnew’s Caerus Global Investors.

Let’s now take a look at hedge fund activity in other stocks similar to Papa John’s International, Inc. (NASDAQ:PZZA). We will take a look at PPDAI Group Inc. (NYSE:PPDF), TransAlta Corporation (NYSE:TAC), Universal Corp (NYSE:UVV), and US Ecology Inc. (NASDAQ:ECOL). All of these stocks’ market caps are similar to PZZA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PPDF | 5 | 7735 | 0 |

| TAC | 9 | 17973 | 2 |

| UVV | 16 | 115912 | -1 |

| ECOL | 10 | 11948 | 2 |

| Average | 10 | 38392 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $38 million. That figure was $359 million in PZZA’s case. Universal Corp (NYSE:UVV) is the most popular stock in this table. On the other hand PPDAI Group Inc. (NYSE:PPDF) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Papa John’s International, Inc. (NASDAQ:PZZA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.