After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of March 31. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Navient Corp (NASDAQ:NAVI).

Is Navient Corp (NASDAQ:NAVI) undervalued? The smart money is in a bullish mood. The number of long hedge fund bets went up by 2 in recent months. Our calculations also showed that navi isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Noam Gottesman, GLG Partners

Let’s go over the fresh hedge fund action encompassing Navient Corp (NASDAQ:NAVI).

How have hedgies been trading Navient Corp (NASDAQ:NAVI)?

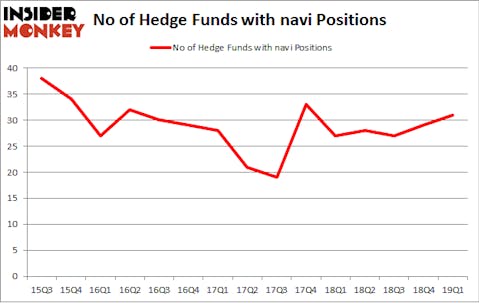

Heading into the second quarter of 2019, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in NAVI over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Joshua Friedman and Mitchell Julis’s Canyon Capital Advisors has the largest position in Navient Corp (NASDAQ:NAVI), worth close to $296.8 million, accounting for 7.2% of its total 13F portfolio. Coming in second is D E Shaw, led by D. E. Shaw, holding a $32.3 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that are bullish comprise Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Ken Griffin’s Citadel Investment Group and Noam Gottesman’s GLG Partners.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. MFN Partners, managed by Farhad Nanji and Michael DeMichele, established the largest position in Navient Corp (NASDAQ:NAVI). MFN Partners had $7.5 million invested in the company at the end of the quarter. Leon Cooperman’s Omega Advisors also initiated a $5.7 million position during the quarter. The other funds with brand new NAVI positions are George Soros’s Soros Fund Management, Ravi Chopra’s Azora Capital, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s now review hedge fund activity in other stocks similar to Navient Corp (NASDAQ:NAVI). We will take a look at Guangshen Railway Company Limited (NYSE:GSH), Viavi Solutions Inc (NASDAQ:VIAV), B2Gold Corp (NYSE:BTG), and Stitch Fix, Inc. (NASDAQ:SFIX). This group of stocks’ market caps match NAVI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GSH | 1 | 4185 | 0 |

| VIAV | 28 | 239221 | 2 |

| BTG | 16 | 122491 | -1 |

| SFIX | 27 | 173160 | 7 |

| Average | 18 | 134764 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $135 million. That figure was $471 million in NAVI’s case. Viavi Solutions Inc (NASDAQ:VIAV) is the most popular stock in this table. On the other hand Guangshen Railway Company Limited (NYSE:GSH) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Navient Corp (NASDAQ:NAVI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on NAVI as the stock returned 14% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.