Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Momo Inc (NASDAQ:MOMO) investors should be aware of an increase in hedge fund interest lately. Our calculations also showed that MOMO isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are dozens of indicators shareholders employ to evaluate publicly traded companies. A duo of the most under-the-radar indicators are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the top fund managers can beat the S&P 500 by a solid margin (see the details here).

We’re going to review the fresh hedge fund action regarding Momo Inc (NASDAQ:MOMO).

How are hedge funds trading Momo Inc (NASDAQ:MOMO)?

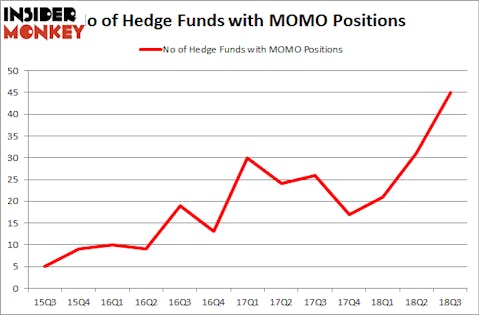

At the end of the third quarter, a total of 45 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 45% from the previous quarter. The graph below displays the number of hedge funds with bullish position in MOMO over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Momo Inc (NASDAQ:MOMO), with a stake worth $327.9 million reported as of the end of September. Trailing Renaissance Technologies was Jericho Capital Asset Management, which amassed a stake valued at $222.6 million. GLG Partners, Three Bays Capital, and Sylebra Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, specific money managers were breaking ground themselves. Three Bays Capital, managed by Matthew Sidman, assembled the most valuable position in Momo Inc (NASDAQ:MOMO). Three Bays Capital had $55.7 million invested in the company at the end of the quarter. Robert Boucai’s Newbrook Capital Advisors also initiated a $46.7 million position during the quarter. The following funds were also among the new MOMO investors: Glen Kacher’s Light Street Capital, Edmond M. Safra’s EMS Capital, and Richard Driehaus’s Driehaus Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Momo Inc (NASDAQ:MOMO) but similarly valued. These stocks are Zillow Group Inc (NASDAQ:Z), BorgWarner Inc. (NYSE:BWA), iShares MSCI ACWI ETF (NASDAQ:ACWI), and AGNC Investment Corp. (NASDAQ:AGNC). This group of stocks’ market caps are closest to MOMO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| Z | 22 | 755335 | -14 |

| BWA | 22 | 724710 | -2 |

| ACWI | 8 | 119261 | 0 |

| AGNC | 15 | 216291 | 4 |

| Average | 16.75 | 453899 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $454 million. That figure was $1.29 billion in MOMO’s case. Zillow Group Inc (NASDAQ:Z) is the most popular stock in this table. On the other hand iShares MSCI ACWI Index Fund (NASDAQ:ACWI) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Momo Inc (NASDAQ:MOMO) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.