Concerns over rising interest rates and expected further rate increases have hit several stocks hard since the end of the third quarter. NASDAQ and Russell 2000 indices are already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points in the first half of the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Libbey Inc. (NYSEAMEX:LBY).

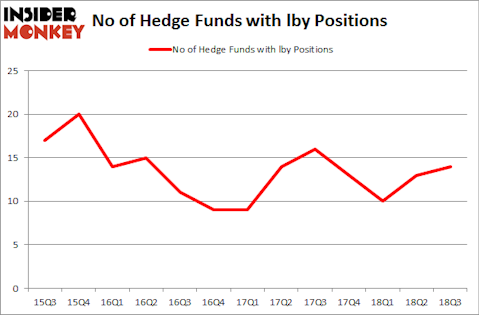

Is Libbey Inc. (NYSEAMEX:LBY) going to take off soon? The smart money is becoming more confident. The number of long hedge fund positions increased by 1 recently. Our calculations also showed that lby isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a glance at the key hedge fund action regarding Libbey Inc. (NYSEAMEX:LBY).

How are hedge funds trading Libbey Inc. (NYSEAMEX:LBY)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the second quarter of 2018. On the other hand, there were a total of 13 hedge funds with a bullish position in LBY at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Brigade Capital was the largest shareholder of Libbey Inc. (NYSEAMEX:LBY), with a stake worth $13.2 million reported as of the end of September. Trailing Brigade Capital was Royce & Associates, which amassed a stake valued at $12.2 million. Spitfire Capital, Wynnefield Capital, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, some big names were leading the bulls’ herd. Two Sigma Advisors, managed by John Overdeck and David Siegel, initiated the most outsized position in Libbey Inc. (NYSEAMEX:LBY). Two Sigma Advisors had $0.2 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $0.2 million investment in the stock during the quarter. The only other fund with a new position in the stock is Mike Vranos’s Ellington.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Libbey Inc. (NYSE:LBY) but similarly valued. We will take a look at Northeast Bancorp (NASDAQ:NBN), Northwest Pipe Company (NASDAQ:NWPX), Safeguard Scientifics, Inc (NYSE:SFE), and Trinity Place Holdings Inc. (NYSE:TPHS). This group of stocks’ market valuations resemble LBY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NBN | 4 | 10503 | 0 |

| NWPX | 7 | 41434 | -1 |

| SFE | 5 | 24738 | 0 |

| TPHS | 7 | 88861 | 1 |

| Average | 5.75 | 41384 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.75 hedge funds with bullish positions and the average amount invested in these stocks was $41 million. That figure was $57 million in LBY’s case. Northwest Pipe Company (NASDAQ:NWPX) is the most popular stock in this table. On the other hand Northeast Bancorp (NASDAQ:NBN) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Libbey Inc. (NYSE:LBY) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.