Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the first 6 weeks of the fourth quarter we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards DexCom, Inc. (NASDAQ:DXCM) to find out whether it was one of their high conviction long-term ideas.

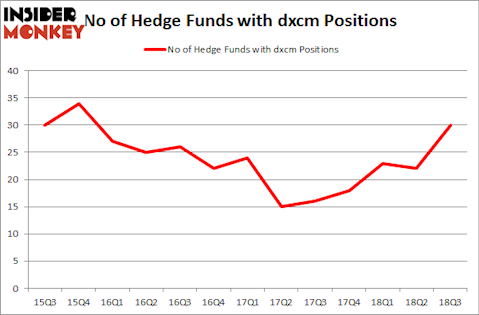

Is DexCom, Inc. (NASDAQ:DXCM) a bargain? Investors who are in the know are taking a bullish view. The number of bullish hedge fund bets improved by 8 lately. Our calculations also showed that dxcm isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s go over the latest hedge fund action regarding DexCom, Inc. (NASDAQ:DXCM).

What have hedge funds been doing with DexCom, Inc. (NASDAQ:DXCM)?

Heading into the fourth quarter of 2018, a total of 30 of the hedge funds tracked by Insider Monkey were long this stock, a change of 36% from one quarter earlier. On the other hand, there were a total of 18 hedge funds with a bullish position in DXCM at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Israel Englander’s Millennium Management has the number one position in DexCom, Inc. (NASDAQ:DXCM), worth close to $189.4 million, amounting to 0.2% of its total 13F portfolio. On Millennium Management’s heels is Citadel Investment Group, led by Ken Griffin, holding a $139.9 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other peers that hold long positions consist of Principal Global Investors’s Columbus Circle Investors, Jim Simons’s Renaissance Technologies and Arthur B Cohen and Joseph Healey’s Healthcor Management LP.

As industrywide interest jumped, specific money managers were breaking ground themselves. Partner Fund Management, managed by Christopher James, created the most outsized position in DexCom, Inc. (NASDAQ:DXCM). Partner Fund Management had $43.7 million invested in the company at the end of the quarter. James Crichton’s Hitchwood Capital Management also initiated a $32.2 million position during the quarter. The other funds with brand new DXCM positions are Dmitry Balyasny’s Balyasny Asset Management, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s go over hedge fund activity in other stocks similar to DexCom, Inc. (NASDAQ:DXCM). These stocks are GrubHub Inc (NYSE:GRUB), The Mosaic Company (NYSE:MOS), EnCana Corporation (NYSE:ECA), and PTC Inc (NASDAQ:PTC). All of these stocks’ market caps are similar to DXCM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GRUB | 38 | 1565269 | 3 |

| MOS | 34 | 831988 | 5 |

| ECA | 32 | 2058468 | 1 |

| PTC | 46 | 1630384 | 6 |

| Average | 37.5 | 1521527 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.52 billion. That figure was $1.0 billion in DXCM’s case. PTC Inc (NASDAQ:PTC) is the most popular stock in this table. On the other hand EnCana Corporation (NYSE:ECA) is the least popular one with only 32 bullish hedge fund positions. Compared to these stocks DexCom, Inc. (NASDAQ:DXCM) is even less popular than ECA. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.