Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Denbury Resources Inc. (NYSE:DNR) from the perspective of those elite funds.

Is Denbury Resources Inc. (NYSE:DNR) a healthy stock for your portfolio? The best stock pickers are buying. The number of long hedge fund positions inched up by 3 in recent months. Our calculations also showed that dnr isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are several signals stock market investors put to use to evaluate publicly traded companies. A pair of the most innovative signals are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the best money managers can outperform the broader indices by a superb amount (see the details here).

Let’s review the latest hedge fund action surrounding Denbury Resources Inc. (NYSE:DNR).

How have hedgies been trading Denbury Resources Inc. (NYSE:DNR)?

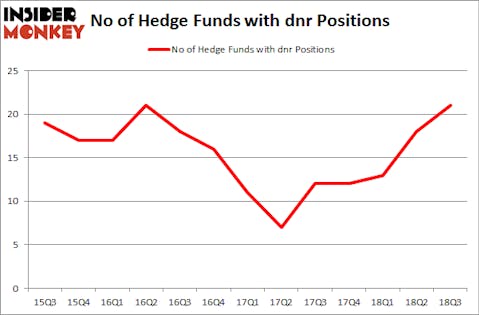

At the end of the third quarter, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in DNR at the beginning of this year. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

More specifically, SailingStone Capital Partners was the largest shareholder of Denbury Resources Inc. (NYSE:DNR), with a stake worth $152 million reported as of the end of September. Trailing SailingStone Capital Partners was D E Shaw, which amassed a stake valued at $30.4 million. Millennium Management, Elm Ridge Capital, and Soros Fund Management were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, some big names have jumped into Denbury Resources Inc. (NYSE:DNR) headfirst. Highland Capital Management, managed by James Dondero, assembled the most valuable position in Denbury Resources Inc. (NYSE:DNR). Highland Capital Management had $4 million invested in the company at the end of the quarter. Louis Navellier’s Navellier & Associates also initiated a $2.2 million position during the quarter. The other funds with brand new DNR positions are Arvind Sanger’s GeoSphere Capital Management and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Denbury Resources Inc. (NYSE:DNR) but similarly valued. These stocks are Columbia Banking System Inc (NASDAQ:COLB), Cyberark Software Ltd (NASDAQ:CYBR), Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD), and Stantec Inc. (NYSE:STN). This group of stocks’ market valuations are closest to DNR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COLB | 11 | 132802 | 2 |

| CYBR | 24 | 407866 | 7 |

| IRWD | 17 | 316714 | 1 |

| STN | 5 | 82481 | 0 |

| Average | 14.25 | 234966 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $235 million. That figure was $286 million in DNR’s case. Cyberark Software Ltd (NASDAQ:CYBR) is the most popular stock in this table. On the other hand Stantec Inc. (NYSE:STN) is the least popular one with only 5 bullish hedge fund positions. Denbury Resources Inc. (NYSE:DNR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CYBR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.