The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Delek US Holdings, Inc. (NYSE:DK).

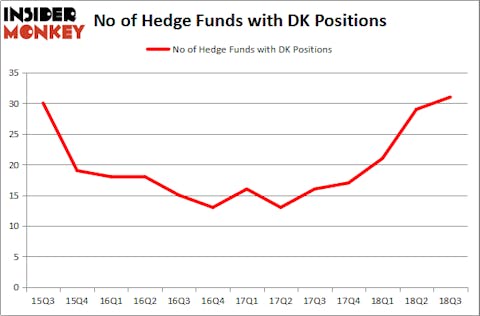

Delek US Holdings, Inc. (NYSE:DK) was in 31 hedge funds’ portfolios at the end of the third quarter of 2018. DK investors should be aware of an increase in hedge fund interest of late. There were 29 hedge funds in our database with DK holdings at the end of the previous quarter. Our calculations also showed that DK isn’t among the 30 most popular stocks among hedge funds.

According to most stock holders, hedge funds are seen as underperforming, outdated investment tools of yesteryear. While there are greater than 8,000 funds trading today, We look at the leaders of this club, around 700 funds. These hedge fund managers direct the lion’s share of the smart money’s total capital, and by watching their top stock picks, Insider Monkey has determined numerous investment strategies that have historically outperformed the market. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a glance at the latest hedge fund action encompassing Delek US Holdings, Inc. (NYSE:DK).

What does the smart money think about Delek US Holdings, Inc. (NYSE:DK)?

At the end of the third quarter, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from the second quarter of 2018. By comparison, 17 hedge funds held shares or bullish call options in DK heading into this year. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

More specifically, Point72 Asset Management was the largest shareholder of Delek US Holdings, Inc. (NYSE:DK), with a stake worth $122.8 million reported as of the end of September. Trailing Point72 Asset Management was Castle Hook Partners, which amassed a stake valued at $58.4 million. Citadel Investment Group, Fisher Asset Management, and Arosa Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. Arosa Capital Management, managed by Till Bechtolsheimer, initiated the most outsized call position in Delek US Holdings, Inc. (NYSE:DK). Arosa Capital Management had $21.2 million invested in the company at the end of the quarter. Rob Citrone’s Discovery Capital Management also made a $10.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Guy Shahar’s DSAM Partners, Matthew Hulsizer’s PEAK6 Capital Management, and George Soros’s Soros Fund Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Delek US Holdings, Inc. (NYSE:DK) but similarly valued. These stocks are Semtech Corporation (NASDAQ:SMTC), Adient plc (NYSE:ADNT), AmeriGas Partners, L.P. (NYSE:APU), and Cushman & Wakefield plc (NYSE:CWK). This group of stocks’ market valuations match DK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SMTC | 13 | 134391 | 1 |

| ADNT | 29 | 706243 | 3 |

| APU | 6 | 14605 | 2 |

| CWK | 15 | 170379 | 15 |

| Average | 15.75 | 256405 | 5.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $256 million. That figure was $404 million in DK’s case. Adient plc (NYSE:ADNT) is the most popular stock in this table. On the other hand AmeriGas Partners, L.P. (NYSE:APU) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Delek US Holdings, Inc. (NYSE:DK) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.