The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Credit Acceptance Corp. (NASDAQ:CACC) .

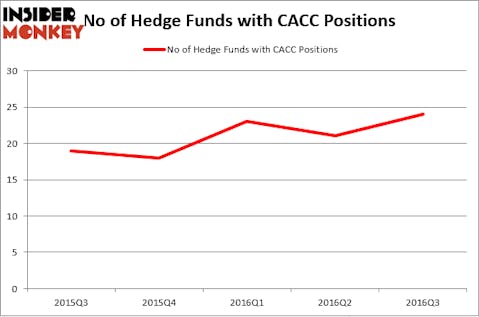

Credit Acceptance Corp. (NASDAQ:CACC) has seen an increase in support from the world’s most successful money managers lately. There were 21 hedge funds in our database with CACC holdings at the end of the previous quarter. At the end of this article we will also compare CACC to other stocks including Yamana Gold Inc. (USA) (NYSE:AUY), Techne Corporation (NASDAQ:TECH), and The Madison Square Garden Co (NASDAQ:MSG) to get a better sense of its popularity.

Follow Credit Acceptance Corp (NASDAQ:CACC)

Follow Credit Acceptance Corp (NASDAQ:CACC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Andrey_Popov/Shutterstock.com

Now, let’s take a look at the latest action encompassing Credit Acceptance Corp. (NASDAQ:CACC).

What does the smart money think about Credit Acceptance Corp. (NASDAQ:CACC)?

Heading into the fourth quarter of 2016, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, an increase of 14% from the second quarter of 2016. By comparison, 18 hedge funds held shares or bullish call options in CACC heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Abrams Bison Investments, led by Gavin M. Abrams, holds the most valuable position in Credit Acceptance Corp. (NASDAQ:CACC). According to regulatory filings, the fund has a $228.8 million position in the stock, comprising 24.9% of its 13F portfolio. The second largest stake is held by BloombergSen, led by Jonathan Bloomberg, which holds a $163.6 million position; the fund has 16% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism contain Jonathan Auerbach’s Hound Partners, William von Mueffling’s Cantillon Capital Management and Edward Goodnow’s Goodnow Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.