We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of Chegg Inc (NYSE:CHGG) based on that data.

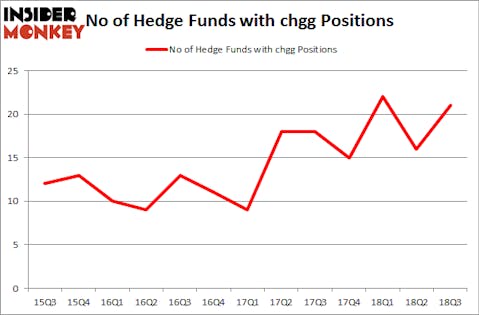

Chegg Inc (NYSE:CHGG) was in 21 hedge funds’ portfolios at the end of September. CHGG has experienced an increase in support from the world’s most elite money managers in recent months. There were 16 hedge funds in our database with CHGG holdings at the end of the previous quarter. Our calculations also showed that chgg isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a lot of metrics stock traders put to use to assess publicly traded companies. A pair of the most innovative metrics are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the best money managers can outclass the broader indices by a very impressive margin (see the details here).

Let’s take a look at the recent hedge fund action surrounding Chegg Inc (NYSE:CHGG).

How are hedge funds trading Chegg Inc (NYSE:CHGG)?

At Q3’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 31% from the previous quarter. On the other hand, there were a total of 15 hedge funds with a bullish position in CHGG at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

Among these funds, Sylebra Capital Management held the most valuable stake in Chegg Inc (NYSE:CHGG), which was worth $188.9 million at the end of the third quarter. On the second spot was Hitchwood Capital Management which amassed $51.2 million worth of shares. Moreover, Greenhouse Funds, Columbus Circle Investors, and Act II Capital were also bullish on Chegg Inc (NYSE:CHGG), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. D E Shaw, managed by D. E. Shaw, assembled the largest position in Chegg Inc (NYSE:CHGG). D E Shaw had $8.7 million invested in the company at the end of the quarter. David Fiszel’s Honeycomb Asset Management also initiated a $7.5 million position during the quarter. The other funds with new positions in the stock are Matthew Hulsizer’s PEAK6 Capital Management, John Osterweis’s Osterweis Capital Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Chegg Inc (NYSE:CHGG) but similarly valued. We will take a look at BancorpSouth Bank (NYSE:BXS), LHC Group, Inc. (NASDAQ:LHCG), PDC Energy Inc (NASDAQ:PDCE), and Sensient Technologies Corporation (NYSE:SXT). All of these stocks’ market caps are closest to CHGG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BXS | 7 | 101577 | 0 |

| LHCG | 25 | 145948 | 1 |

| PDCE | 19 | 181951 | 4 |

| SXT | 11 | 74341 | -3 |

| Average | 15.5 | 125954 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $126 million. That figure was $369 million in CHGG’s case. LHC Group, Inc. (NASDAQ:LHCG) is the most popular stock in this table. On the other hand BancorpSouth, Inc. (NYSE:BXS) is the least popular one with only 7 bullish hedge fund positions. Chegg Inc (NYSE:CHGG) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LHCG might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.